4 free banking apps you’ll use every day

Banking apps can come in handy as you manage your finances, but with so many options out there, how do you know which ones you should add to your smartphone and tablet? Well, don’t worry — we’ve narrowed it down for you in this list of our top four free banking apps selections.

1. ACU mobile app

Of course, we have to mention the ACU mobile app as one of our free banking apps, which makes it easier for you as members to check your bank account balances and history, transfer funds, pay bills, deposit cheques and make Interac e-transfers. Besides making purchases, you can manage your finances whenever and wherever you are in a secure and convenient way. It’s like having your bank branch at your fingertips 24/7. Do you have family and friends with ACU bank accounts? You can also easily transfer funds to another ACU member’s account with the app.

2. Mint

Are you looking for an app that can provide insights into your money management and spending? Look no further than Mint, which connects to your various accounts and promises to provide helpful insights into your finances — all in the name of helping improve your overall financial wellbeing.

This app puts the numbers that matter to you most front and centre, while offering alerts for fraud and identity theft as an extra layer of security. By tracking your accounts, bills and balances in one helpful platform, you’ll always know what’s going on with your finances. In addition, a new feature called MintSights™ can potentially unlock even more money-saving tips just for you.

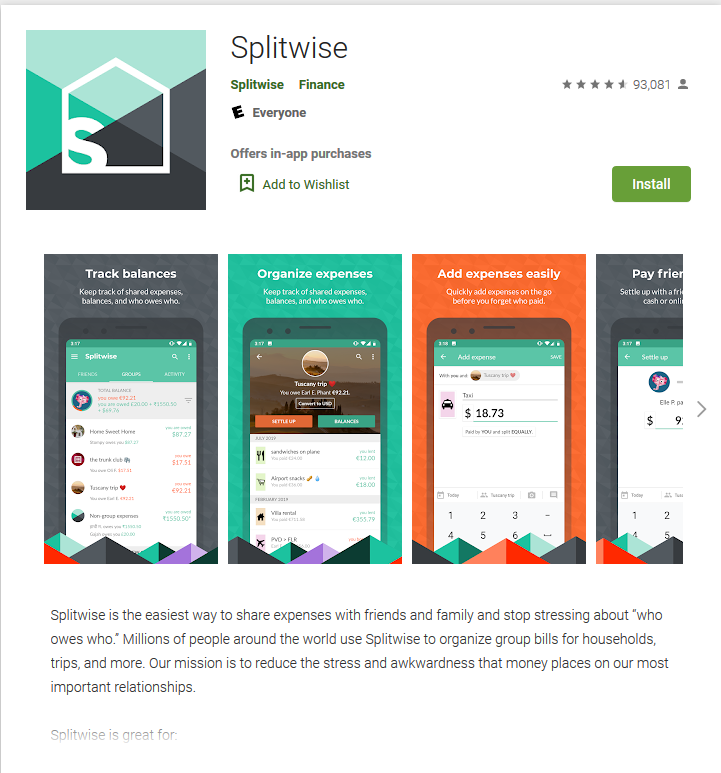

3. Splitwise

When you’re out with friends at a restaurant and it comes time to split the bill, do you ever feel like you end up getting the short end of the stick? Well feel that way no more with Splitwise, which makes sharing expenses with family and friends easy. Splitwise isn’t just for restaurant bills either. It also works great for roommates splitting rent and apartment bills, weddings and bachelorette parties, group trips, couples sharing household expenses and any other situation where you share expenses. With so many practical uses, this one should be on everyone’s free banking apps list!

To use Splitwise, just add your group members and enter your expenses — either divided evenly, by dollar amounts or by percentages. (You can even enter different currencies, which is great while travelling abroad.) Splitwise will take care of the rest by doing the calculations and telling everyone what they owe and who they should pay. It doesn’t get any easier than that!

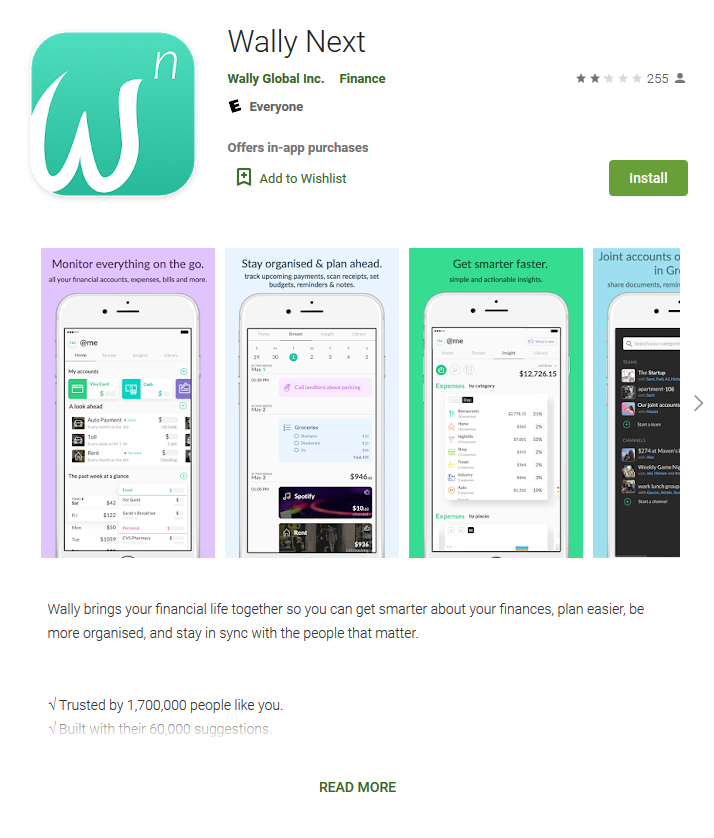

4. Wally Next

Wally Next is a personal finance app that helps you compare your income to your expenses and get a better understanding of where all your money goes. This app focuses on giving you the right tools you need to manage your personal finances better. While some of us are old school and use pen and paper, others use computer software and Excel. Wally Next goes the extra mile and offers a better way by giving you a 360-degree view of your finances. You’ll know what exactly is coming in, what’s going out, and you’ll feel empowered to make future financial decisions.

Up Next

Sustainability: How ACU is turning words into action

A hand holding a seedling

For ACU, Pride radiates outward

“I’ve always wanted to instill a change in the world for the better,” says Cristina McCourt, Financial Account Manager Trainee and member of the ACU Pride Committee, an employee-led resource…

Royal Aviation Museum travels to its final destination—with ACU’s help

A stone’s throw from the main terminal of Winnipeg Richardson International Airport you’ll find one of Canada’s hidden gems, where the airplanes are a little more exciting than your typical…