Posted: October 06, 2023 by Vawn Himmelsbach in Advice/Perspectives, acu mobile app, acu online banking, Digital account opening, digital banking, Ed Live chat

ACU’s new digital solutions make mobile banking easy

Digital innovations are crucial for enhancing member experiences in the financial industry.

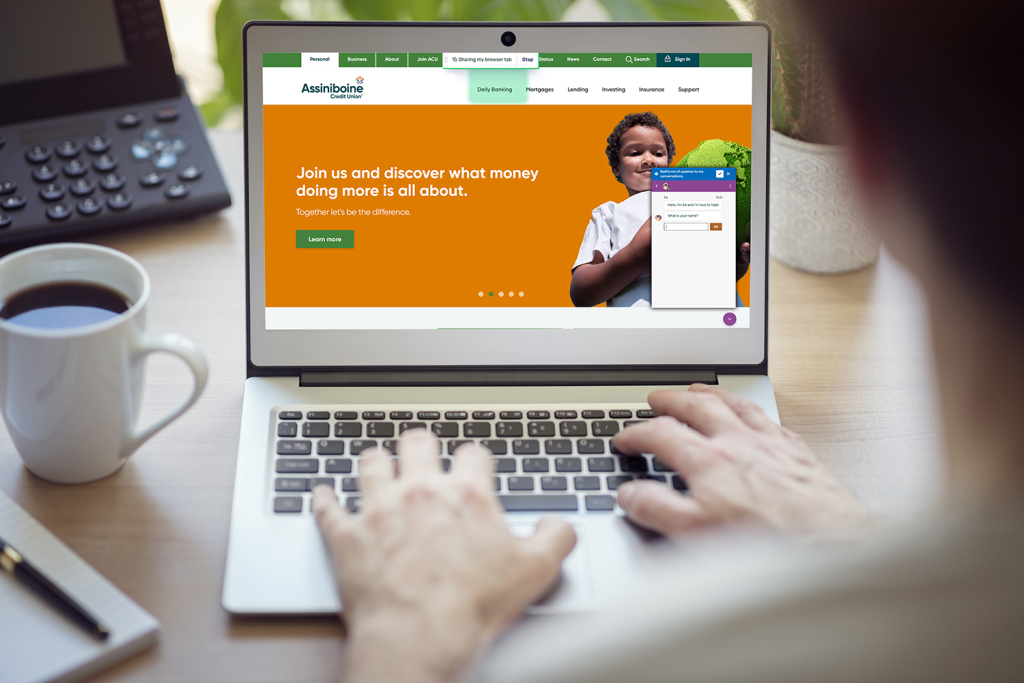

That’s why ACU has introduced several digital innovations, from a streamlined membership opening process, to increased personalization, and live chat with co-browsing.

We talked to the key team members who brought these innovations to life and what they mean for members.

Camila Maciel—Director, Project Management & Business Integration

Camila, you led the team on the Digital Membership Opening (DMO) project. How will this make it easier for new members to open an account?

Our goal was to expand how prospective members join ACU by offering a quick, convenient and streamlined way to start their ACU membership. It adds a whole new level of convenience, as it lets people effortlessly open a new account from the comfort of their home, on any device, at any time of day, without having to visit a branch.

It’s easy to open an account digitally.

Try it today!

How does this feature help improve the overall member experience?

The account opening process has been turbo-charged with features like identity verification and real-time application processing. We use a modern, multi-tiered system that provides risk assessment and FINTRAC-compliant ID verification for new members. We’re also benefitting internally from our new onboarding system, with smoother account openings and reduced administrative burdens. These initiatives allow our ACU team to concentrate on providing an even better member experience.

Brad Emberly—Manager, Digital Delivery

Brad, you’re the lead on ACU’s mobile app updates. What are your favourite features on the app?

I like that you can personalize the app by adding your own background and profile image. You can also add transactions to your “Favourites” list.

Are there any new updates to ACU’s app?

One of the updates is the void cheque feature. Members can download a void cheque to provide their direct deposit and withdrawal information.

We’ve also updated live chat with co-browsing so that members can communicate directly with an ACU service advisor, in real time, for an additional level of support. We’re working on a few more exciting features for 2024. Stay tuned!

Goretti Frias DiMartino—Manager, Advice-MCC (featured in image below)

Brigitte Marshall—Director, Member Communication Centre

As call centre managers, can you explain the idea behind Ed, ACU’s new live chat service?

Our members have embraced Ed as a new digital tool, allowing members and non-members to connect with the ACU team using their preferred communication channel. One exciting feature is the ability to collaborate with members through co-browsing. We’ve received feedback about how quickly and easily we can troubleshoot issues with this tool.

How can members use Ed to help with their financial needs?

Live chat provides us with more opportunities to engage with members in real time—helping with digital banking activities, providing advice in a timely manner and providing links to more information. The ability to collaborate through co-browsing also allows us to guide members through self-serve features that are available online 24/7.

Jennifer Ewacha—Business System Analyst

Jen, you’re the project manager for digital appointment booking. How does this feature make banking easier for members?

We’re providing members with self-serve options to book meetings at a convenient date and time. Members can book an appointment online, via computer or mobile device, with a variety of different meeting options to choose from including video, phone or in-person at a branch or other location. We’ve found that the options members choose may depend on what they want to talk about: online for basic account management and questions, but in-person to discuss bigger items, like wealth or personal loans or mortgages. Regardless of the option, members receive streamlined communication, via SMS and/or email, for automatic reminders and flexibility to reschedule or cancel.

Sara Rusak—Chief Digital and Operations Officer

Sara, what new digital products and services have you helped bring to life?

In my 11+ years at ACU, I’ve been fortunate to participate in many impactful projects that have brought new and enhanced digital capabilities to our employees and members. Most recently, we’ve added new ways to meet and communicate through virtual appointment booking, and e-signature to allow members to sign documents from anywhere. We also have an ambitious list of new solutions on our roadmap.

How do these initiatives set ACU apart from other credit unions?

We are very focused on bringing new digital experiences to our members, and we look beyond banking to understand the innovations in other industries as well. This inspires us to consider how we can bring the ease of other solutions to the banking experience. We also want to ensure that the end-to-end journey helps our members feel confident and supported in communicating with ACU and discussing financial advice. Often, it’s not just about what we roll out, but how we do it, that makes the difference.

What digital solutions have you initiated that members may not know about yet?

Members may have yet to fully discover how to personalize the app to make it their own. For example, I have a few saved “Favourites” transactions that allow me to easily repeat an ongoing transaction, but without the commitment of a regularly scheduled transfer—like transferring an allowance to my kids. I also love the ability to set a personal background image on the app. ACU has beautiful default images, but it’s easy to make the app your own and upload a photo. Right now mine is a picture of my dog, Abby!

Want to try out these digital solutions for yourself? Head over to our website and click our live chat feature button in the bottom right corner to get started! Or familiarize yourself with our Digital Banking options.

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Borrow, General, Money tips

Read more ›

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…