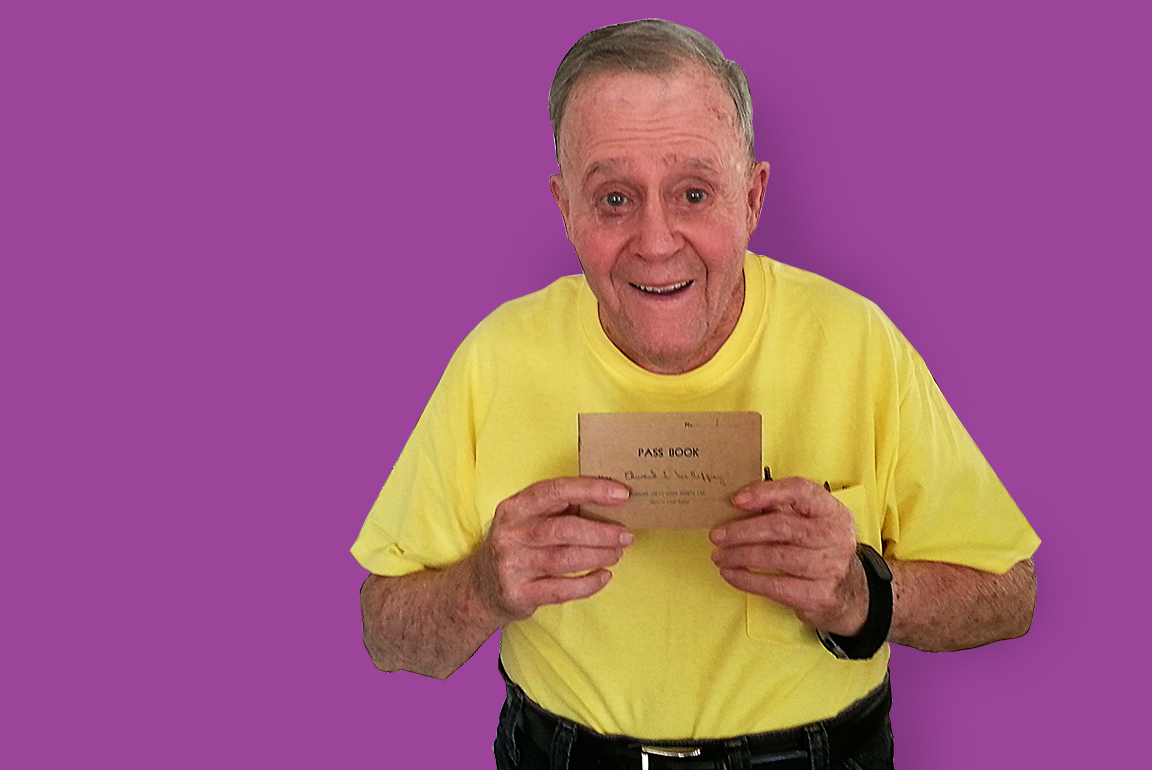

Ed McCaffrey, Assiniboine Credit Union’s Founder and First Member

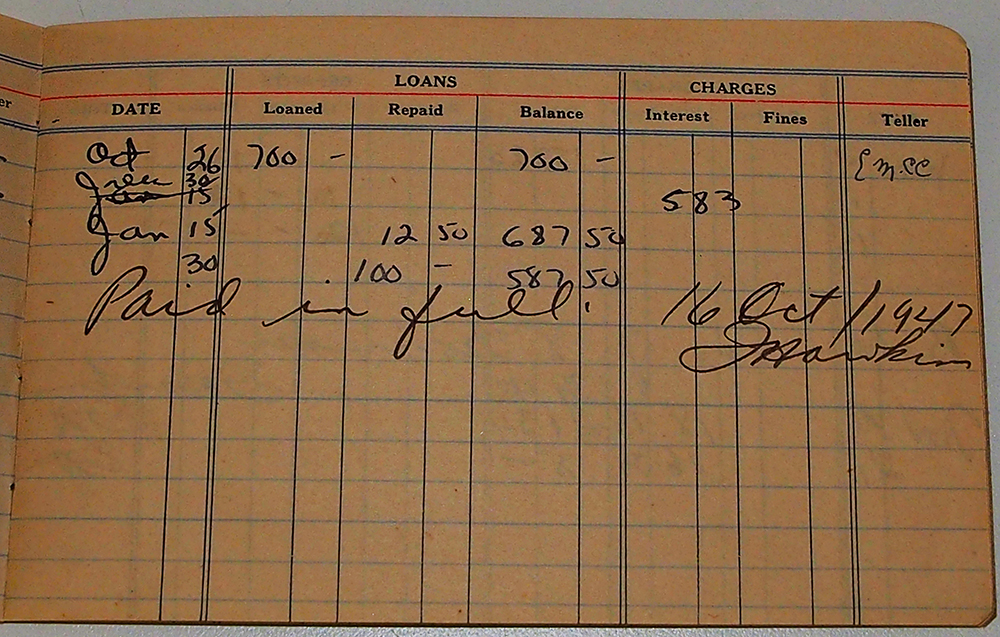

Assiniboine Credit Union’s first member Ed McCaffrey vividly remembers how and why he and his former colleagues started Assiniboine. Now over 90 years old, and although he has packed and moved many times over the decades, Ed still has his “member #1” Assiniboine passbook made out in his name.

Meaningful Beginnings

It was 1943, and although the economy was bouncing back from the Great Depression, Canada was feeling the effects of War World II. Unable to serve in the war, Ed — a 23-year old transit worker with a social conscience — watched as fellow co-workers struggled to pay their bills, were ignored by banks and fell victim to payday lenders when they were in need.

Ed, his wife Anne (a former bank teller), and a few of his colleagues from Winnipeg Electric Company got together to start Assiniboine Credit Union Society Ltd, with a mission to support families with a “genuine need”. Although credit unions were still fairly new in Manitoba, they envisioned starting a credit union with a mission to support people who needed to borrow money just to pay their regular bills, get through a crisis and avoid the usury fees of banks.

Joining the Manitoban Credit Union Movement

Their office was located on Assiniboine Avenue, thus the Assiniboine Credit Union Society Limited was born, becoming the tenth credit union chartered in Winnipeg; 47th in Manitoba. Just five years earlier caisse populaires, Manitoba’s first financial co-operatives, had been created to support the francophone farming community as rural families struggled out of the Great Depression.

Ed and his eight work colleagues, started Assiniboine as an open bond credit union, which meant anyone in the community was welcome to join. Assiniboine’s growth was slow at first and primarily built on membership from Ed’s workplace, The Winnipeg Electric Company.

The Value of a Loan

The first Assiniboine loan underlined the credit union’s social mission: a member borrowed $50 to pay an outstanding medical bill at a time before national Medicare was available.

We made loans for reasonable purposes – like medical needs. If you had a genuine need we would do our best to see that you got a loan.

Branching Out

Before the end of the decade, Assiniboine opened a branch on Pembina Highway at Waller Avenue. And by the end of the ‘40s, Ed’s credit union had 33 members and total assets of $2,567.

Over the next 70 years, their good idea continued to see major growth as Assiniboine survived economic challenges and political changes. Through it all, Assiniboine has maintained and deepened their vision to provide financial services to the underserved, support local communities and work toward environmental sustainability.

It’s both a long way, and yet a short distance, from our 1943 start when Ed McCaffrey created a very good thing, indeed. Thank you Ed, for grounding your banking mission in values that put the well-being of people first. Today, Assiniboine honours that vision by ensuring that our decisions, our actions, our profits, and our influence make a positive social and environmental impact. It’s not just how we do business, it’s why we do business.

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…