Posted: January 22, 2024 by Sean Cooper in Invest, Money tips, Can I withdraw from TFSA, How does a TFSA work, How much can I contribute to my TFSA?, How to open a TFSA, TFSA limit, What is a TFSA

Finance basics: How does a TFSA work?

Ever since its introduction in 2009, the Tax-Free Savings Account (TFSA) has been a hit with Canadians. Yet, despite its widespread popularity, there still seems to be some confusion about this handy account. Don’t worry — with some quick Q&A, we’ll help clear up any confusion.

Contrary to its name, you shouldn’t think of the TFSA as a typical savings account. Rather, it’s more like an expandable storage container for your money and investments, which can be a powerful way to grow your investments — completely tax-free!

If you’ve asked, “How does a TFSA work?” but are still unsure, you’re not alone.

Here are some of the most common TFSA questions people ask when learning about the basics of finance. These will help set your foundational knowledge on the path to increase your wealth.

What is a TFSA?

Essentially, the TFSA is a registered account that helps you save and invest, but many people confuse it with the Registered Retirement Savings Plan (RRSP). While the RRSP’s main purpose is saving towards retirement, the TFSA is a lot more flexible, helping you save towards both short-term and long-term goals. (More on that in a bit.)

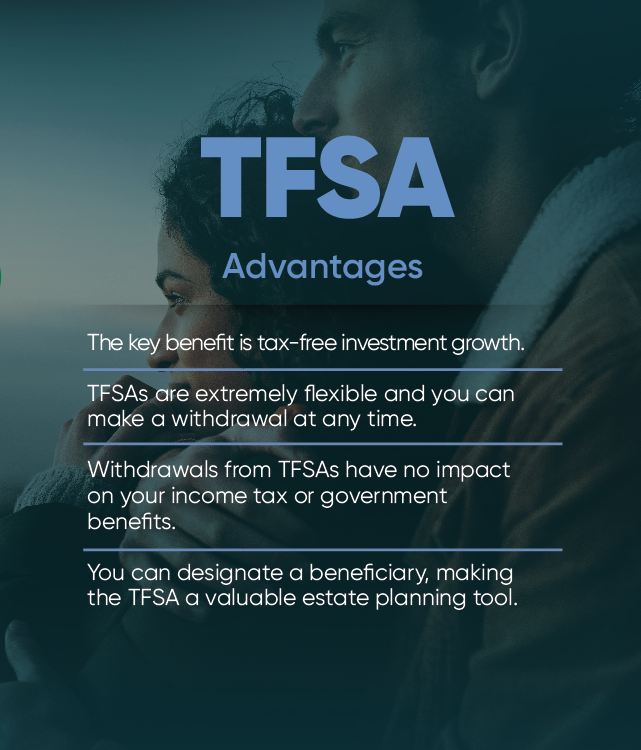

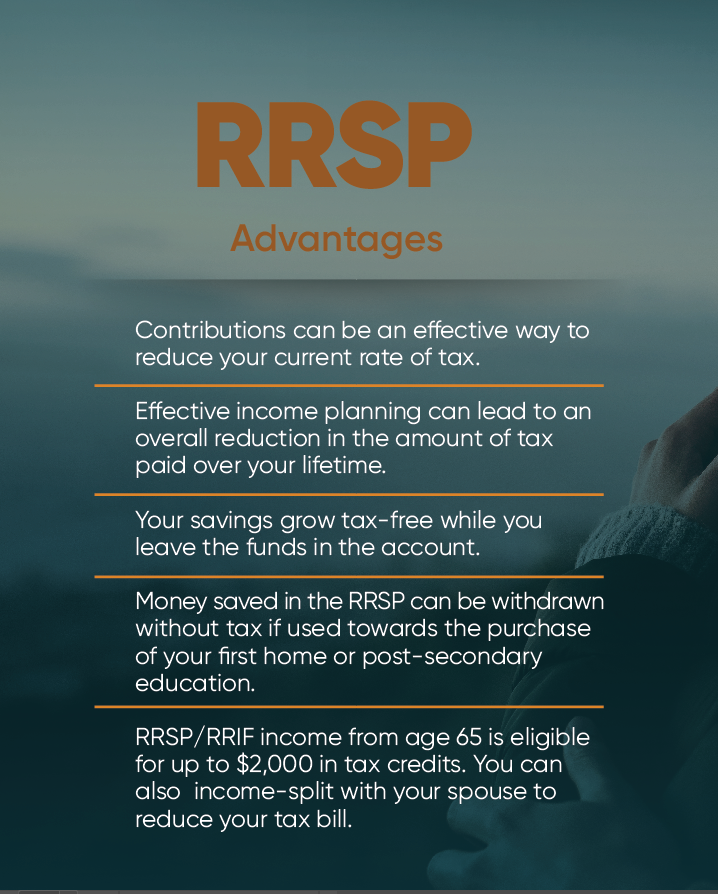

Compare the advantages of RRSPs vs. TFSAs

Based on its name, it would seem that the TFSA is just a savings account, but that’s not true. Although you can hold a savings account inside your TFSA, you may not be getting the most out of it if you do.

In fact, the TFSA can also hold a variety of investments, including mutual funds, stocks, bonds and Guaranteed Investment Certificates (GICs). Of course, you’ll want to choose the investments that make the most sense for you based on your savings goal, and your ACU financial advisor can help you make those selections. For example, if you’re saving for a short-term goal, such as a family vacation, you’ll probably want to stick with something safer like a GIC.

Is a TFSA better than an RRSP?

Both have their advantages. The TFSA is similar to the RRSP in the sense that any money held inside grows tax-free.

However, unlike the RRSP, you don’t get a tax refund for contributing to it. Where the TFSA really has a leg up on the RRSP is that you don’t have to pay any taxes when you withdraw money.

One disadvantage of the TFSA is that it’s easy to over-contribute. Be careful never to contribute more than the total room in your TFSA, otherwise you could face a penalty tax of one percent per month. Ouch!

How do I open a TFSA?

Opening a TFSA is pretty easy, and most credit unions and banks in Canada offer them. So your first step is to contact your ACU financial advisor or book an appointment online. Your advisor can quickly walk you through the process and get your account set up.

As part of the setup, you’ll need to provide your Social Insurance Number (SIN) and date of birth to register your TFSA. Keep in mind that you’ll also have to be at least the age of majority, 18 years old in Manitoba, to open a TFSA.

When should I contribute to the TFSA?

While you can contribute to the TFSA at any point in the year, people often have questions about it around tax time when they’re also thinking about RRSPs.

December 31 is technically the deadline for contributing to your TFSA each year, although any unused contribution room is carried forward to the following year.

How much can I put into my TFSA?

The Government of Canada has defined maximums you can contribute to your TFSA each year. In 2024, you can contribute up to $7,000 to your account. In addition, if you have an unused contribution room from years past, you can also use that up. (CRA provides more information here.) But once again, be careful not to exceed your total contribution limit. If you’re unsure, have a quick chat with your ACU financial advisor.

| TFSA Contribution Limit | |

|---|---|

| 2009 | $5,000 |

| 2010 | $5,000 |

| 2011 | $5,000 |

| 2012 | $5,000 |

| 2013 | $5,500 |

| 2014 | $5,500 |

| 2015 | $10,000 |

| 2016 | $5,500 |

| 2017 | $5,500 |

| 2018 | $5,500 |

| 2019 | $6,000 |

| 2020 | $6,000 |

| 2021 | $6,000 |

| 2022 | $6,000 |

| 2023 | $6,500 |

| 2024 | $7,000 |

| Total: $95,000 | |

Can I withdraw from my TFSA?

Yes, you can. Generally, you can withdraw any amount you’d like from your TFSA at any time. However, CRA cautions that you can only replace or re-contribute back into your account if you still have available contribution room.

For example, if you contribute $7,000 in 2024 and then take out $4,000, you cannot re-contribute further funds this year without incurring a penalty. This is because you’ve already hit the maximum contribution space of $7,000 this year.

But in another scenario, let’s say you contribute $5,000 this year. Assuming you can’t carry over contribution room from previous years, your 2024 contribution allotment is now $2,000. Even if you were to take out $3000 from your TFSA, you would still only be able to contribute a further $2,000. That’s because the total contribution amount is $7000, regardless of the extra ‘room’ created by the $3000 withdrawal.

Getting the most of your TFSA

If your contribution has been put into an investment, you’ll have the potential to be earning higher interest or seeing the value of your funds potentially grow with the market, depending on the investment you choose.

But the most important part of this account is that when you withdraw funds, you will not be taxed on your gains. If your $6,000 contribution in 2024 grows to $7,000 and you withdraw all the funds, you will keep all $7,000 without paying any additional tax. Now that’s a bonus!

As you can see, the TFSA is a lot more than just a savings account. By understanding how a TFSA works and the investments you can hold inside, you can make better use of it in the years to come.

If you’re ready to take the next step to improve your personal wealth, book a financial health check-in with an ACU financial advisor. We’d be happy to review your accounts, help you set up a TFSA and ensure you’re contributing the right funds to meet your financial goals.

Up Next

Community stories

Read more ›

Sustainability: How ACU is turning words into action

A hand holding a seedling

Advice/Perspectives, Community stories

Read more ›

For ACU, Pride radiates outward

“I’ve always wanted to instill a change in the world for the better,” says Cristina McCourt, Financial Account Manager Trainee and member of the ACU Pride Committee, an employee-led resource…

Advice/Perspectives, Borrow, Business growth

Read more ›

Royal Aviation Museum travels to its final destination—with ACU’s help

A stone’s throw from the main terminal of Winnipeg Richardson International Airport you’ll find one of Canada’s hidden gems, where the airplanes are a little more exciting than your typical…