Follow these ‘5 Cs’ when applying for a business loan

If you need financing to run or grow your company, you’re not alone. In 2022, 15% of all Canadian businesses applied for new financing in one or more of these categories:

- line of credit

- term loan

- non-residential mortgage

Businesses seek financing for many reasons, from hiring more staff, buying equipment, inventory and raw materials to renovating existing facilities or buying land for new ones.

However, asking for commercial financing is very different from asking for a personal loan, given the larger amount of risk involved with lending to a company. According to Statistics Canada, more than 7% of Canadian companies that applied for business financing were turned down in 2022.

To boost your chances of approval, experts from Assiniboine Credit Union’s Business Financial Centre (BFC) and Community Financial Centre (CFC) offer some helpful insights.

Applying for a business loan: Getting approved

Before submitting your financing application, there are certain things you should prepare in advance—and some important things to consider along the way.

ACU works with many business owners and entrepreneurs to guide them through the process of getting a loan approved. You’ll start by meeting with an account manager who will get to know you, learn about your business and gather the required documents to process the application. The account manager will be looking to satisfy the ‘5 Cs’ of credit to assess if your business represents an acceptable level of risk.

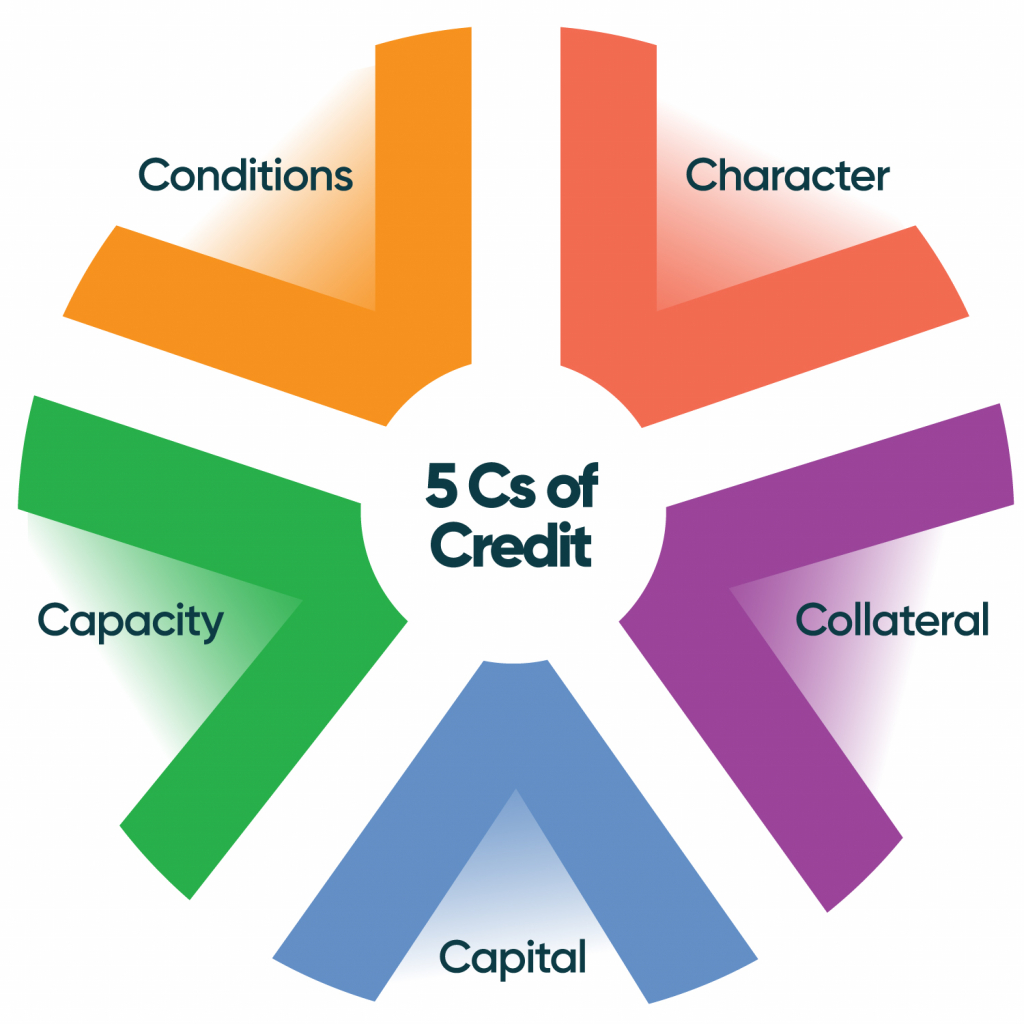

The ‘5 Cs’ of Credit

The ‘5 Cs’ of credit are criteria that a business must satisfy in order to qualify for a loan.

This risk assessment will help determine whether the loan gets approved, the interest rate you will pay and the overall terms and conditions. Your business’ performance, along with the ability to provide adequate collateral, will also factor into the decision.

Related: Getting the right loan for your business

1. Character

In the character assessment, the account manager will evaluate your ability to plan, control and organize the business. In this step, first impressions matter. Make sure you are dressed for success and that you bring a positive and collaborative attitude.

One of the first things an account manager looks at is your business acumen and experience. Have your business plan ready. Include details such as a market trend analysis, SWOT analysis and business operations plan, with reference to the current economic environment. It helps to do plenty of advance research on the factors that will have an external influence on your business and show you’ve prepared your business for future success.

This step is all about credibility. Having a plan with data to back it up will help you build trust with your account manager and improve your chances of approval.

2. Capacity

Capacity is about demonstrating that the business will be able to make the payments on the loan. To do this, there will be a review of any available historical financial results including financial statements and projections.

You’ll need to prepare financial records, including financial statements, a pro-forma income statement and cash flow projections. Your personal credit history and net worth will also be reviewed to determine the creditworthiness of you as the owner. If you have all this documentation ready to review, it will help streamline the conversation.

“I definitely recommend that members have their total budget and costs prepared in advance. If they don’t have their financials ready, it makes it difficult for us to put a package together and slows down the process,” explains Michelle Hardy, Commercial Account Manager at ACU.

She adds that while a smaller company can probably just submit their business tax returns, larger firms are usually required to provide financial statements professionally prepared by an accountant.

A new business without historical financial statements should prepare a pro forma (a set of forecasted financial projections), plus a detailed business plan that demonstrates a clear understanding of the industry it’s targeting. Take note that a new company with no proven track record will likely require strong guarantees for any loan it receives.

According to Martin Petras, Associate Director of Commercial Real Estate and Syndications at ACU, helpful documents to gather might include:

- year-end financial statements for the past three years

- year-to-date financials showing accounts receivable and accounts payable

- bank statements for the most recent three-month period

- a phase one environmental site assessment (ESA)

- a building condition report

- a rent roll, if it’s a multi-tenant property

- documents confirming company ownership

- proof of downpayment, if applicable

Your account manager will determine project viability through the strengths, opportunities and risks found in your business plan, including financial forecasts and strategies to achieve sales and expense targets.

3. Capital

For existing businesses with more financial history, other factors will come into play, such as your year-over-year growth in terms of net revenue/sales, gross margin and net income. These are important indicators of your company’s current and future health. The loan proposal will speak to the project at hand and describe its impact on the business.

While analyzing your present and past financial performance, your Account Manager will evaluate your business growth, profitability and cash flow. They will also review your business’s liquidity (through analysis such as the current ratio) to evaluate your company’s ability to pay its liabilities in a timely manner. Profitability indicators such as gross profit margin and net income are among an Account Manager’s key measures to see if a loan will be repaid.

If you are starting a new business, then your business plan, financial projections and the strength of the individual guarantor’s personal covenant provide indicators of the company’s viability. Your account manager will then look at your ability to generate positive cash flow and income from operations, since this is where your loan payments to the credit union will come from.

Cash flow is particularly important in a rising interest rate environment, says Hart Garfield, Senior Commercial Account Manager at ACU.

“Going through that cash flow analysis will help determine sensitivity around whether you can handle higher rates when the time for renewal arrives or when a construction project converts to term financing. If not, then higher equity levels may be required to ensure the financing meets your needs,” he explains.

4. Conditions

As part of the loan approval, the account manager will determine the terms and conditions of financing that will keep the credit union’s risk at an acceptable level throughout repayment.

For all forms of commercial lending, a review of borrowing facilities occurs at least once per year. This helps to monitor the loan performance and determine if your company is adhering to both performance and financial agreements.

Understanding all the conditions of any financing agreement is crucial, so make sure you’re aware of all the details at this stage—and what will be required of your business in the future. If the risk profile of your business increases over time, or some other unacceptable event occurs, the credit union may require that you pledge additional collateral—or the loan may be called and repayment demanded in full.

5. Collateral

Business loans almost always require collateral such as commercial equipment, real estate, vehicles or other valuable assets. The lender will inspect and substantiate the collateral you are willing to pledge to ensure it meets requirements.

However, not all collateral is acceptable for all types of lending. For example, commercial equipment is not accepted as collateral for a revolving line of credit. Your account manager can walk you through the types of collateral that can be accepted for the loan you need.

Keep in mind that collateral can play a much more important role in the event of an unfortunate downturn in business. For example, if the business cannot repay the loan, the credit union would take ownership of the collateral in order to liquidate it and use those funds to reduce or eliminate the debt. If that collateral is of vital importance to business’ operations, that could further affect its viability.

The final decision

Our account managers are a great source of help and advice with regards to planning for the financial needs of your business. ACU has been lending to businesses of all sizes for over 80 years, and our account managers see several business plans each week, giving us tremendous experience to draw from when working with members.

Nigel Mohammed, Director of ACU’s Community Financial Centre (CFC), explains the extra level of attention an ACU advisor brings to this process.

“One of the ways ACU demonstrates our ‘values in action’ is through our commitment to education and sound advice. This approach goes beyond fulfilling the specific financial transaction and instead looks to member’s long term success. Whether a start-up or growing business, ACU recognizes the impact of small businesses on entrepreneurs, employees, neighbourhood renewal and the broader local economy.”

Even though account managers take an objective approach to reviewing business lending proposals, there are times when business needs may not match what the credit union can approve.

“If a business is seeking financing to develop office space for commercial tenants, for example, the impact of hybrid work will need to be considered in the overall risk as many businesses continue to adapt to the work from home model, which influences the need for office space.” Nigel noted.

It’s important to be prepared for these potential risks, challenges and outcomes, and to have an open conversation with your account manager to discuss options for present and future financing.

ACU is always happy to work with your business to help you find the right financing options for continued success.

If you’re ready to take the next step in business financing, don’t hesitate to reach out to our dedicated business experts at the BFC and CFC.

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…