Posted: May 18, 2021 by James Burns in Borrow, Money tips, Manitoba mortgage, mortgage calculator, mortgage pre-approval, mortgage rates, Winnipeg mortgage

How much mortgage can I afford?

Before you even start hunting for a new home, the first question you need to ask is, how much mortgage can I afford? And by “afford,” we don’t mean how much do you think you’ll be able to pay on a monthly basis. This question is more focused on the price range of the home you should be searching for, or how much mortgage and cash on hand you’ll need.

The amount you will qualify for when shopping for a Manitoba mortgage depends on several financial factors, which your mortgage lender will review. To get prepared for that eventual conversation, it helps to know what they’ll be looking for — and what information you’ll need to have ready to apply for a mortgage.

Need a refresher on what to expect in your homeownership and mortgage journey? Check out this resource.

1. How much down payment you’ll need

You need to have a down payment of at least 5% of the value of your new home. This money needs to come from:

- Your own savings

- Your RRSPs (as part of the Home Buyers’ Plan)

- A non-repayable gift from a close family member

- From the sale proceeds of an existing property

- A combination of all of these

Any down payment below 20% will require mortgage default insurance. The lower your down payment, the higher the premium, though it can be added to your mortgage amount.

If you want to avoid mortgage default insurance, it’s easy to work out the maximum price you can afford to pay for a home. Let’s say you have a $50,000 down payment:

$50,000 ÷ 20 x 100 = $250,000 maximum price you can budget to buy a home.

Learn more about mortgages: Your top Manitoba mortgage FAQs answered

2. How much will this home cost me?

Many homebuyers ask themselves, how much mortgage can I afford? However, a better question to ask is, how much mortgage will my financial institution lend me?

To help answer this, there are two ratios that mortgage lenders use as part of how much mortgage you’ll qualify to receive.

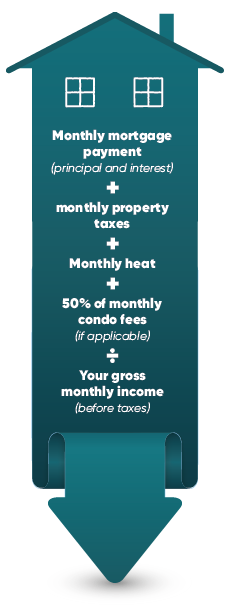

The first is the Gross Debt Service (GDS) ratio, which tells a mortgage lender how much of your monthly income you’ll have to use to cover all your housing expenses. Basically, can you afford the costs of the home?

GDS is calculated as shown below:

As an example, let’s say every month you pay $2,000 for your mortgage, principal and interest, $200 in tax and $100 for utilities. Your total expenses are $2,300. If your gross monthly income is $7,500, then your GDS would be calculated as $2,600 divided by $7,500, which equals 30.7%.

Extra details: Many lenders want this ratio to be below 32%, though some will allow GDS ratios up to 39% if you have good credit and a reliable source of income. Naturally, the condo fees portion only applies to condo buyers.

3. How much does my debt cost me?

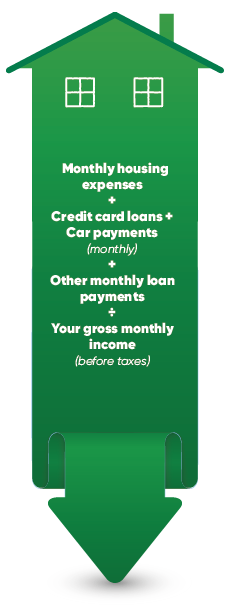

The other ratio that mortgage lenders will look at is the Total Debt Service (TDS) ratio, which adds in all your additional debts on top of those other monthly costs. Once you factor in your loans, minimum payments on credit cards debt, can you still afford the ongoing monthly payments on a home?

This is how TDS is calculated:

As an example of TDS, let’s take the same total monthly expenses of $2,300 from before, and now add $200 of credit card payments, a $350 car payment and $100 of other monthly loan payments you might have to make. The total of monthly debt of $2,950 divided by your $7,500 gross monthly income would equal 39.3%.

Extra details: Many lenders want this ratio to be below 40%, though some may allow TDS ratios up to 44%. Note that for outstanding credit card bills, many lenders will calculate the monthly payment as a percentage of the outstanding amount owed (often 3%), rather than the minimum monthly interest payment.

Is there an easy way to calculate how much mortgage I can afford

Ultimately, a mortgage lender needs to know you’ll be able to have enough money to make all your monthly payments. These ratios and calculations protect the lender, but they also protect you from going over budget and falling into financial trouble.

Calculating your monthly mortgage payment can be tricky if you do it on your own, as it will depend on several factors:

- The amount of the loan

- The mortgage interest rate

- The amortization period (the number of years it will take to pay off the mortgage)

This is why it can be far easier to use a mortgage calculator. Learn how to easily find out how much mortgage you can qualify for in part two of “How much mortgage can I afford?”

Or jump to our handy ACU mortgage calculator now.

Get pre-approved for a mortgage

To get an even more accurate picture of how much mortgage you can afford, ACU can provide you with a pre-approved mortgage. Our financial advisors can also help you to work out how your new mortgage payments will fit into your budget and financial plan.

Just call us at 1.877.958.8588 or schedule an appointment online to speak with one of our financial advisors to find out how much mortgage you can get. We’re happy to help.

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Borrow, General, Money tips

Read more ›

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…