Posted: February 13, 2025 by James Burns in Borrow, General, Money tips, budgeting to buy a home, homebuying costs, Manitoba mortgage, mortgage calculator, mortgage pre-approval, mortgage rates, Winnipeg mortgage

How to use a mortgage calculator to budget better

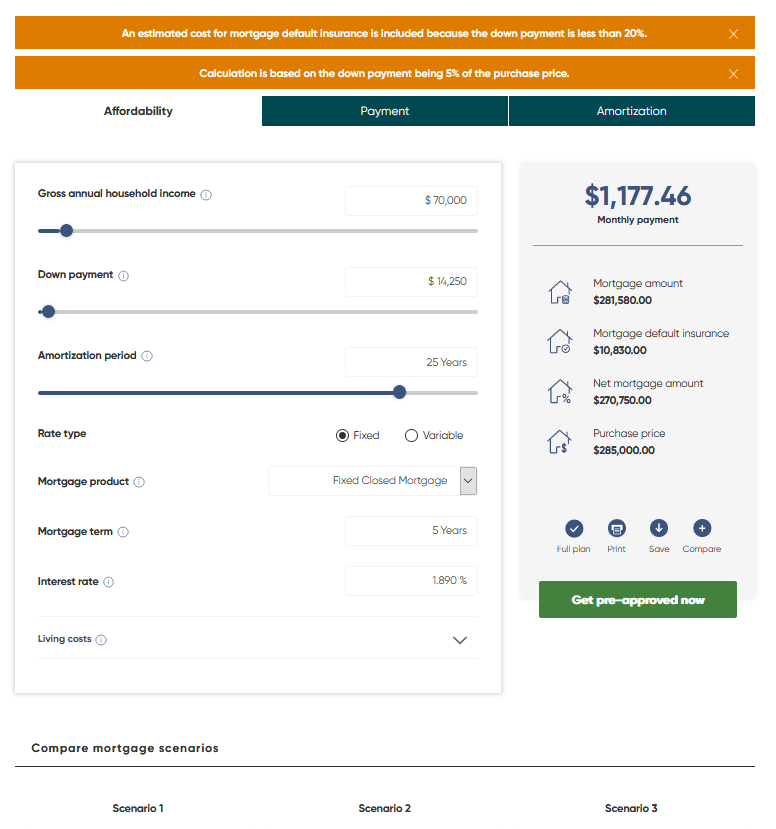

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting.

A mortgage lender will review specific financial figures when determining how much mortgage you can afford, as we explained in part one of this series. But if you want to crunch the numbers yourself, it’s much easier with the help of a handy mortgage calculator.

We’ve designed our ACU Manitoba mortgage calculator to be extremely easy to use. It can work out your mortgage amount based on either how much mortgage you can afford to borrow, the monthly payments you would make or the shortest amortization period you could have.

Here’s exactly how it works:

What to enter into a mortgage calculator

To use our mortgage calculator, just enter the following amounts:

- Your gross household income (before tax)

- The amount you have saved for a down payment

- Your preferred amortization period (the number of years it will take to pay off the mortgage)

- Whether you want a fixed rate or variable rate mortgage

- The length of the mortgage term (the years your contract will be in effect, typically five years)

- The mortgage rate (See our latest rates here)

- Living costs:

- Property taxes

- Condo fees

- Heating costs

- Debt payments

What a mortgage calculator tells you

Once those figures are entered, our affordability mortgage calculator will automatically work out:

- The maximum Manitoba mortgage amount you can borrow

- The purchase price of the home you can buy

- The monthly mortgage payment

- The mortgage default insurance (if your down payment is below 20%)

- The interest you’ll pay over the term of your mortgage contract and the amortization period

- The amount you’ll owe at the end of your mortgage contract term

Our Manitoba mortgage calculator also lets you compare several scenarios, such as different Manitoba mortgage rates, amortization periods or down payments. You can also adjust any of the numbers and see how that can impact your results, which helps you plan different options for your financial future.

Other homebuying costs: Budgeting to buy a home

It’s important to remember that when you’re shopping for a mortgage and buying a new home, you must save more money than just your down payment. There are also closing costs you’ll have to pay before you move in, which can include:

- Legal fees

- Survey costs

- Appraisal fees

- Land transfer taxes

While the first three costs could mount up to as much as $1,500+, land transfer tax could be the highest closing expense. For example, for a property costing $300,000, you would pay $3,720 in land transfer tax in Manitoba.

It’s also wise to factor in your new mortgage payments into your monthly budget and financial plan, and possibly make some necessary changes if this is higher than the rent you may have been paying previously. Also, be sure to add any new expenses to your budget that you wouldn’t have had to worry about as a renter, such as home insurance, property taxes and expenses for the upkeep of your new property.

Learn more about mortgages: Your top Manitoba mortgage FAQs answered

Get pre-approved for a mortgage at ACU

Whenever you’re ready for the next step, ACU can help you get pre-approved for your mortgage. Our financial advisors will guide you through the process to find a mortgage that fits your budget and financial plan.

Call us at 1.877.958.8588 or schedule an appointment online to speak with one of our financial advisors. We’re happy to help.

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Business growth, Community stories

Read more ›

Building resilience through Manitoba’s local food initiative

Photo Credit: St. Norbert’s Farmers Market photo supplied by Direct Farm Manitoba.