Posted: July 14, 2022 by Asterisk Blog in Borrow, Money tips, Assiniboine Credit Union, house hunters, mobile mortgage specialists, mortgage pre-approval

Homebuying tips from ACU’s Mobile Mortgage Specialists

Buying a home can be simultaneously exciting and nerve-wracking. And with so much to consider and do, there never seems to be enough time. That’s why our team of ACU Mobile Mortgage Specialists is set up to meet you when and where it’s convenient for you — or at your nearest ACU branch.

A Mobile Mortgage Specialist can help you secure a mortgage, refinance an existing home, plan for a future purchase and so much more. Whether you’re actively house-hunting right now, investigating budget and options, or considering a vacation property down the road, the team is happy to help guide you.

For more personalized advice, we’re always happy to review your financial health and house buying goals to make sure you’re ready to move into your dream home!

With that in mind, below are five Manitoba homebuying and mortgage tips from the Mobile Mortgage Specialists.

Manitoba Homebuying Tip 1. Figure out what you can afford before you start house hunting

You’ve decided to start house hunting, but where do you actually begin the process? Logically it might seem obvious – make your wish list, determine your desired city, town or neighbourhoods, and start looking at houses.

However, the biggest favour you can do for yourself is to figure out how much you can afford before finding your dream home!

By speaking with one of our Mobile Mortgage Specialists, determine everything from how much you can borrow to an approximate amortization schedule (the payments you’ll be making over the lifetime of the mortgage). The team will help you budget and plan for the right-sized home.

Get an estimate now! Find out how much you can afford with our easy-to-use mortgage calculator.

Manitoba Homebuying Tip 2. Down payment

Another critical step in your homebuying journey is your down payment. Most institutions require a minimum of 5% of the purchase price to consider you for a mortgage — but the more you’ve saved, the better.

Your down payment will need to come from:

- Your own savings

- Your RRSPs (as part of the Home Buyers’ Plan)

- A non-repayable gift from a close family member

- From the sale proceeds of an existing property

- A combination of all of these

If you’ve just started saving or have only thought about it, determining a plan of action on how much and how long to save is a big step. Our Mobile Mortgage Specialist can assist you with determining the best way to accomplish this part of the mortgage process.

Learn how the new FHSA can help first-time homebuyers save.

Manitoba Homebuying Tip 3. Get a mortgage pre-approval before you make an offer (but not too early!)

Once you start house hunting, you never know when the right home will come on the market. Getting your mortgage pre-approved will make it quicker and easier to submit an offer when you’re ready.

Ensure you start your pre-approval early, as you’ll need to provide information such as employment income, a list of assets and liabilities, as well as permission to obtain a credit bureau report.

Keep in mind, timing is everything. Once you get the green light, the mortgage pre-approval will usually be good for 90 days. So you’ll need to keep in conversation with your Mobile Mortgage Specialist who can assist you as you search for the right home, and if you need a little more time.

Get this handy mortgage pre-approval checklist to help you prepare.

Manitoba Homebuying Tip 4. Take advantage of government incentives available to you

Did you know that the Government of Canada has established incentives that help make homeownership an easier decision for young Canadians? For example, the First-Time Home Buyer Incentive can help you reduce your monthly mortgage without adding extra costs. And the Home Buyers’ Plan (HBP) allows you to withdraw from your RRSP to buy or even build a qualifying home.

Other programs such as the Manitoba Rural Homeownership Program may be an option, depending on where you want to live, your current income and other qualifying criteria.

Discuss these programs with your Mobile Mortgage Specialist to learn if you qualify and how to maximize your potential savings.

Manitoba Homebuying Tip 5. Don’t forget about your closing costs and other expenses

You’ve put in the offer, and it’s been accepted. Now what?

Don’t forget that the home purchase price doesn’t include things like home inspections, appraisals or legal fees to close the deal. It’s crucial to include these costs when you’re making your budget.

There are also closing costs you’ll have to pay before you move in, which can include:

- Legal fees

- Survey costs

- Appraisal fees

- Land transfer taxes

While the first three costs could mount up to as much as $1,500+, land transfer tax could be the highest closing expense. For example, for a property costing $300,000, you would pay $3,720 in land transfer tax in Manitoba.

Learn more about the costs of a mortgage.

Ready to explore a mortgage? We’ll even come to you.

Take the first step towards homeownership. Reach out to chat with one of our friendly Mobile Mortgage Specialists today.

We can answer questions you have about home financing, discuss available programs and work with you to determine the best fit for your scenario. No obligations and zero pressure. We’re here to help, and we’re happy to meet you at a time and place that’s convenient for you.

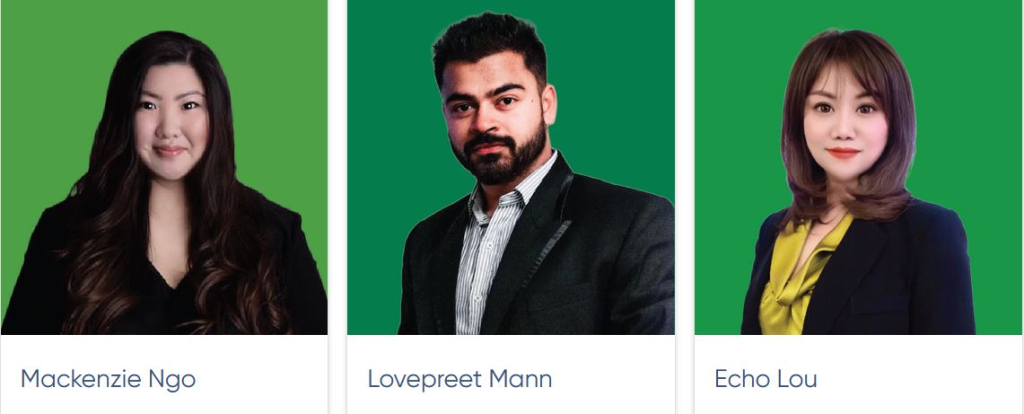

| Mobile Mortgage Specialist 204.296.8574 mngo@acu.ca | Mobile Mortgage Specialist 431.337.6800 lmann@acu.ca | Mobile Mortgage Specialist 204.227.9167 elou@acu.ca |

Up Next

Advice/Perspectives, Community stories

Read more ›

Manitoba Theatre for Young People dreams big with new campaign

A home for creativity and imagination for generations, Manitoba Theatre for Young People (MTYP) has helped thousands of children and youth across the province discover the joy of theatre since…

Advice/Perspectives, Community stories

Read more ›

Zoongizi Ode creates housing solutions to help Indigenous youth aging out of care

For the past decade, Indigenous-led not-for-profit organization, Zoongizi Ode (Zoon-gai-zai O-day), has been working on smoothing the transition for Indigenous children aging out of Manitoba’s child welfare system. Along with…

Money tips, Save

Read more ›

How much money should I save for retirement?

‘The best is yet to come!’ If this classic saying holds true, then your retirement is certainly something to look forward to! Leisurely time with family, friends, travel and hobbies…