RRSP vs. TFSA: Which is best for you?

During RRSP season, people often ask, “Should I invest in an RRSP or a TFSA?”

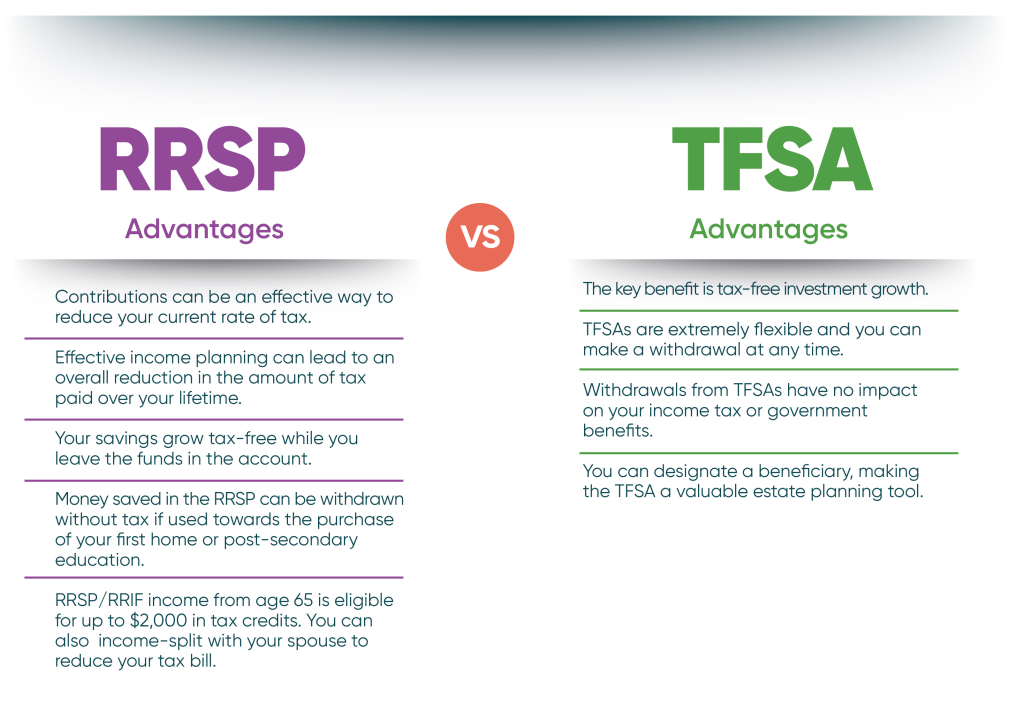

While both of these types of accounts allow your investments to grow tax-free, they each have different rules. Let’s take a closer look at RRSP and TFSA accounts to help you decide which might be best for you.

What is an RRSP and how does it work?

A Registered Retirement Savings Plan (RRSP) is a government tax-deferred account. In this plan, the contributions you make are deducted from your taxable income. You will enjoy a reduction of income tax in the year you add money to your RRSP — and your savings will grow tax-free within the account.

Within your RRSP account you can have all manner of investments, from savings accounts and GIC deposits, to mutual funds, equities, bonds and exchange-traded funds (ETFs). Your money can be allocated into any of these products and the interest, dividends or capital gains that your investments earn will be sheltered from taxation.

When you retire, the money is typically converted to a Registered Retirement Income Fund (RRIF). At that point, you would begin to withdraw your saved money from the plan and would have to pay tax on the withdrawal. This allows you to defer paying tax on that income for as long as you hold these funds in the account.

For 2019, the maximum contribution for your RRSP is the smaller of these two options: either 18% of your income or $26,500. If you don’t contribute the maximum, you can also carry unused contributions forward to the following year.

What is TFSA and how does it work?

The Tax-Free Savings Account is very similar to the RRSP, but the difference between these plans lies in the rules around taxation.

The money you have contributed to the TFSA can be allocated to any of the same savings and investment products that are eligible for the RRSP. The interest, dividends or capital gains that your investments earn will be sheltered from taxation.

Unlike the RRSP, your contributions to the TFSA do not attract a deduction from income tax. The money in your plan is therefore regarded as ‘after-tax’ proceeds, and you will not pay any taxes on withdrawals.

For 2023, the maximum contribution is $6,500 — and just like RRSPs, you can carry unused contributions forward to next year.

So, which is better for you: an RRSP or a TFSA?

The answer is different for everyone. It depends on your circumstances and why you’re saving.

Related: 6 simple answers to make estate planning easy

Helping you decide

These savings plans are effective tools that you should use to your advantage. Our advisors can explain the differences between an RRSP and TFSA to help work out which account is best suited to your individual circumstances.

Call or email us today to set up an appointment with an advisor and start building your tax-free investments.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. .

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…