Using your home equity to buy a vacation home or revenue property

Like many people who dream about purchasing a second home — such as your dream vacation home, cottage or investment property — cash flow could be holding you back. Maybe you don’t have enough in your savings for a down payment on top of your existing mortgage. Or perhaps you don’t want to feel cash-strapped while you take care of two properties.

But if you already own a house, you might have more flexibility than you realized. Here’s how you can make the most of your existing home equity as a vacation home or investment property down payment to climb the property ladder.

Leveraging your first home equity to buy a second home

If you have equity built in your existing home, along with a steady income, you could use it as a down payment for the purchase of a second home.

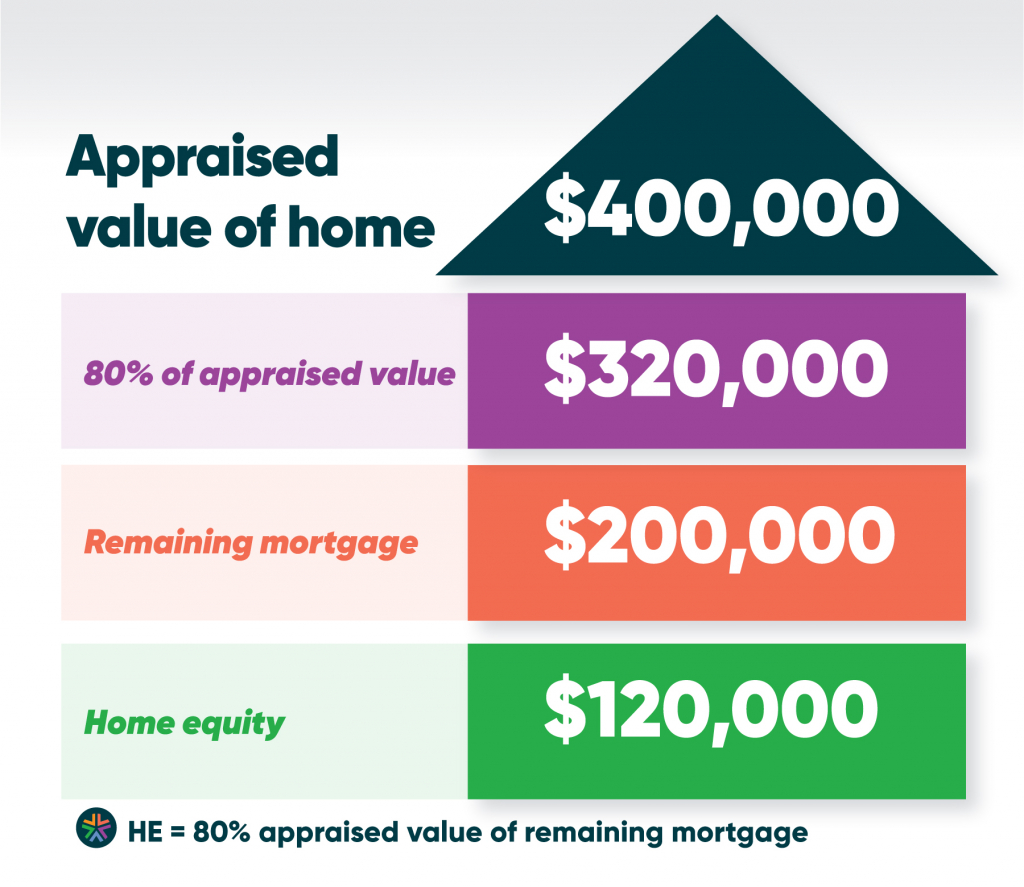

First, what does “home equity” really mean? Simply put, home equity is equal to the appraised value of your home minus your remaining mortgage balance.

Appraised home value — Remaining Mortgage Balance = Home equity

Naturally, if you’re a new homeowner you probably won’t have much home equity built up yet, but that will change in time. As you pay down your mortgage, your home equity increases. And if the value of your home increases over time, as is often the case for those who’ve owned their property for many years, your home equity will also increase.

Even if you’ve been a homeowner for quite a while, you might not have a lot of savings in your account. However, having seen your property value increase, you could still leverage that home equity for a down payment on an investment property. (This is where a financial advisor can also look at your entire financial position to outline all the options available for buying your vacation or rental property.)

How to buy second home using your home equity

This process requires two separate applications:

- The first is to refinance the mortgage on your existing home for the purpose of taking remaining equity out and will serve as a down payment for the purchase of the second home.

- The other application is to finance the purchase of the second property (vacation home or revenue property) where the down payment could come from the equity built in your existing home.

Note that you will need to qualify to carry both mortgages at the same time.

When you refinance your home, you can leverage up to 80% of the appraised value of your home (minus the remaining mortgage) in urban areas such as Winnipeg. For rural areas, you can leverage up to 65% of the appraised value.

For example, let’s say your home in Winnipeg is appraised at $400,000 and your current mortgage is $200,000. Based on the below calculations, you’d have up to $120,000 in home equity to leverage and put down as a down payment on an investment or rental property.

Now, if you’d like to buy a cottage for $150,000, that existing home equity puts you well on your way. You would only require a new mortgage for $30,000 ($150,000 purchase price – $120,000 down payment = $30,000 new cottage mortgage).

In this example, you would have two mortgages:

- $320,000 mortgage on your existing home

- $30,000 mortgage on your new cottage property

Down payment requirements for vacation or rental properties

For revenue and vacation properties, most financial institutions require a down payment in the amount of 25% or more of the rental property purchase price. On the other hand, for secondary homes (owner occupied or occupied by an immediate family member) or vacation homes, the down payment can be as low as 5%.

With a 5% down payment, Canadians can own a vacation or secondary home through Genworth Canada Vacation/Secondary Homes Program, subject to eligibility.

To ensure you are eligible to take advantage of this program, book an appointment with your ACU financial advisor.

Refinancing options: Points to consider

Your primary residence is not the only type of property you can refinance to take the equity out. The secondary home, vacation home or income property can be used if you have built enough equity and as long as you have the financial ability to borrow.

How you will use your equity is up to you — whether that’s to pay off short-term debt or a personal loan, to fund home renovations, to buy a new car or even to take the family on a much-needed vacation.

Consolidating debt into your mortgage is worth considering if you’re paying off high-interest loans on credit cards, for example. This could potentially improve your financial position, allowing you to take on a second property.

When refinancing your home, it’s important to consider avoiding pre-payment penalties by using a ‘blend and extend’ approach — if your financial institution allows that option. ‘Blend and extend’ means merging your existing mortgage rate with the new current mortgage rate for a brand-new blended rate.

The length of the mortgage could also come into play in these situations. For example, if you have 12 years left on your existing mortgage, you could extend it back to a 25-year mortgage, along with a 25-year mortgage on the second property.

Your second home future

By exploring all your options and finding the right mortgage solutions, you can lessen the restrictions on cash flow and put yourself in a more comfortable financial position. This might be the perfect time to leverage your home equity to make your dreams a reality.

And after you’ve signed all the paperwork on your new vacation home or rental property, you’ll be ready for some well-deserved rest. Go ahead and put your feet up — on the dock, by the fireplace or under the sun — and maybe even watch as your new revenue stream starts coming in.

Considering leveraging your home equity for a second home down payment? Your ACU financial advisor can help. Get in touch today to set up an appointment.

Up Next

Manitoba Theatre for Young People dreams big with new campaign

A home for creativity and imagination for generations, Manitoba Theatre for Young People (MTYP) has helped thousands of children and youth across the province discover the joy of theatre since…

Zoongizi Ode creates housing solutions to help Indigenous youth aging out of care

For the past decade, Indigenous-led not-for-profit organization, Zoongizi Ode (Zoon-gai-zai O-day), has been working on smoothing the transition for Indigenous children aging out of Manitoba’s child welfare system. Along with…

How much money should I save for retirement?

‘The best is yet to come!’ If this classic saying holds true, then your retirement is certainly something to look forward to! Leisurely time with family, friends, travel and hobbies…