17 Tips to Protect Your Account From Online Fraud

Online fraud can take many forms, and deceitful scammers are experts at manipulating people to fall into their traps. It’s critical that you become aware of the current risks.

Whether snared in an email, on a website, within an online form or ambushed in money transfers, even the savviest and most aware people can become victims of clever scammers.

As we recognize Fraud Prevention Month in March, get to know these 17 tips to help protect you from online fraud.

Email Safety

1. Never reply to a spam email, even to unsubscribe

Often, this just serves to “verify” your address to scammers. The best course of action is to delete any suspicious emails without opening them.

2. Turn off the “viewing pane”

Just viewing the email may send a verification notice to the sender that yours is a valid email address.

3. Be skeptical of senders

Legitimate credit unions, banks and financial institutions will never ask you for your account details in an email or ask you to click on a link in an email to access your account. Never call a telephone number or trust other contact details that you see in a spam email.

4. Never follow a link in an email

This is especially true when you don’t know the sender. However, some fraudulent emails can be designed to look like a known contact. If you want to access a website from an email link, think twice. Instead, use a bookmarked link to the website or type the address directly into the browser yourself.

Related: Learn how to get the right alerts for your account activity.

Internet Protection

5. Use security software

Install software that protects your computer from viruses and unwanted programs and make sure it is kept current. If you are unsure, seek the help of a computer professional.

6. Check website addresses carefully

Scammers often set up fake websites with addresses very similar to legitimate websites.

7. ‘Free’ downloads can cost you

Beware of websites offering “free” downloads (such as music, adult content, games and movies). Downloading these products may install harmful programs onto your computer without you knowing.

8. Avoid clicking on pop-up ads

This could lead to harmful programs being installed on your computer, another path to online fraud.

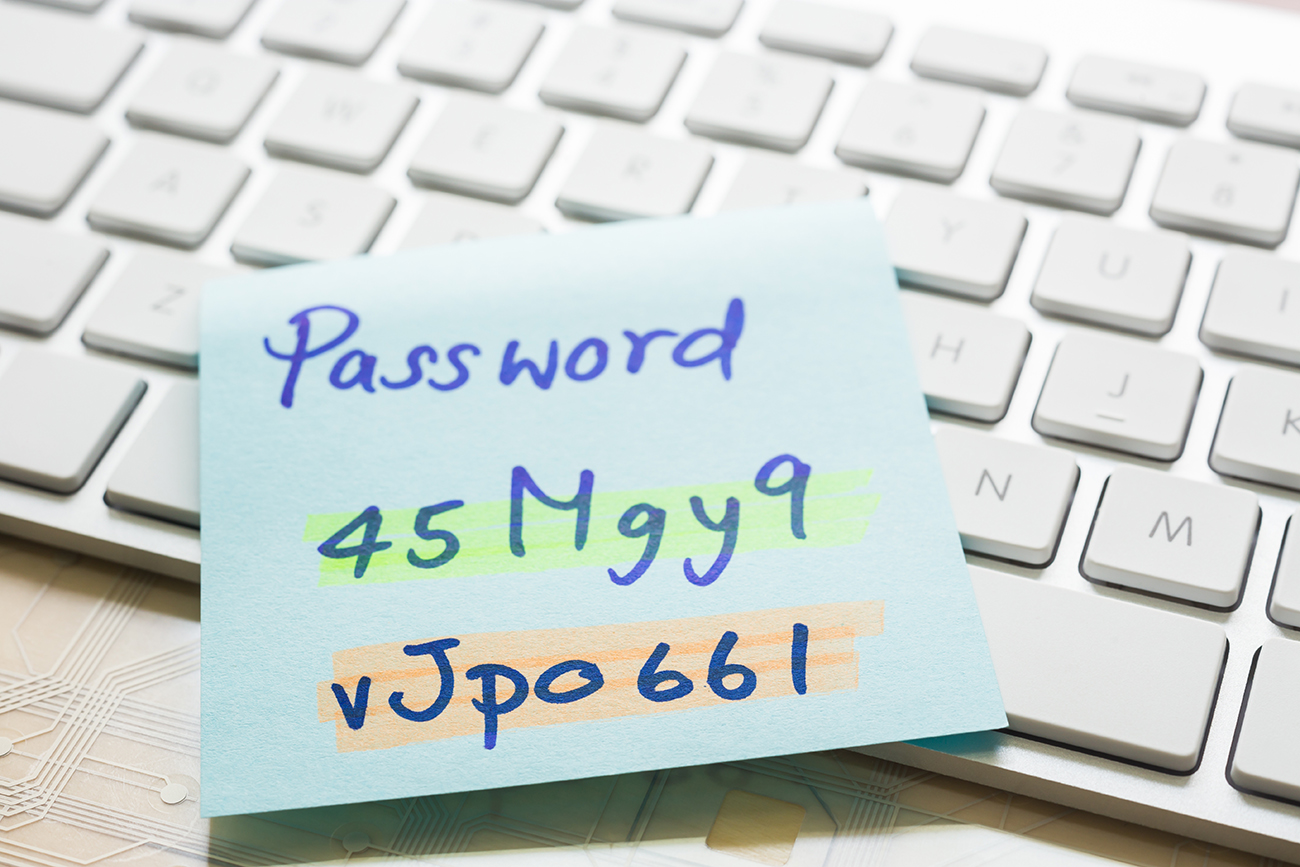

9. Create strong passwords

Choose passwords that would be difficult for anyone else to guess — for example, passwords that include letters and numbers. You should also regularly change your passwords.

10. Keep track of online buying

Only pay via a secure site when buying online, and print out copies of all transactions. If using an Internet auction site, note the ID numbers involved and read all the security advice on the site first.

Read more about online fraud: Learn the fundamentals of Fraud Protection Month.

Your Identity

11. Keep your details private

Only give out your personal details and information where it is absolutely necessary and when you trust the person you are dealing with. Never enter your personal, credit card or online account information on a website that you are not sure is genuine. Likewise, don’t send those details through an email.

12. Be cautious about auto-complete

Some computer software will auto-complete online forms. This can give Internet scammers easy access to your personal details and credit card information.

13. Use public computers with caution

Avoid using computers at libraries or Internet cafes to do your Internet banking or online shopping. When using public computers, clear the history and cache of the computer when you finish your session. Be aware of “evil twin” Wi-Fi hotspots that impersonate legitimate networks. Always confirm you are connecting to the correct network.

Money Matters

14. Be wise when emailing money

Never send money to anyone that you don’t know and trust. Never accept e-Transfers that you are not expecting.

15. Don’t lose out when you’re a winner

Do not send any money or pay any fee to claim a prize or lottery winnings. Legitimate contests and lotteries will have more appropriate methods for you to redeem your money or prize.

16. Use your own account carefully

Sometimes, fraudsters post “jobs” asking you to simply use your own bank account to transfer money on behalf of another person. These could be a front for money-laundering activity, which is a serious criminal offence. It’s important to stay clear of these types of activities.

17. Know your recipients

Avoid transferring or wiring any refunds or over payments back to anyone you do not know. Where possible, learn more about the recipient and handle this in person or through more secure methods.

Stop fake SIM swaps: Prevent and recover from smartphone fraud

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…