Posted: November 30, 2023 by Matt Cohen in Community stories, community, non-profit organisation, SEED Winnipeg

A united approach to building community and improving lives

United Way is a Canadian philanthropic organization that serves over 5,000 communities across the nation. Its network of 71 independent, non-profit offices share the same mandate — to move people from poverty to possibility by building strong and healthy communities.

For over 50 years, United Way Winnipeg has been supporting that vision by investing in local programs and providing funding for critical front-line support that helps thousands of people every day.

Helping at a local level: United Way Winnipeg

Donations go directly to agencies and programs that strengthen local communities. The financial empowerment programs that are delivered by United Way Winnipeg agency partners empower people by delivering money management and financial literacy workshops.

“We’re always looking for opportunities that have the greatest impact possible, regardless of the initiative,” says Jason Granger, United Way Winnipeg’s Director of Community Investment and Capacity. “Our multi-sector approach results in strong partnerships focused on pressing issues that communities face.”

No matter how small the initiative, the results can have a big impact. Take, for example, a Winnipeg family who participated in a program supported by United Way Winnipeg to save for and buy a purple sofa. That purchase was about more than a piece of furniture to the family, it also gave them peace of mind. It became part of a gathering space for their family and something to call their own. That’s the impact of community investment.

Partnership with a proven history

There are countless examples of United Way Winnipeg uniting sectors toward a common goal, but one of the most fruitful partnerships has been with ACU.

For over a decade their shared values, commitment to community and focus on sustainability, have helped Manitobans of all walks of life manage their money, find meaningful work and save for the future.

“As a values based financial institution committed to social and economic sustainability of local communities, ACU is proud of the strong partnership with SEED Winnipeg spanning over 4 decades supporting entrepreneurs, individuals and families access banking services, asset building and financial literacy programs allowing them greater participation and inclusion on their journey to financial empowerment”.

Nigel R. Mohammed

Director, Community Financial Centre & Small Business Distribution

This alignment delivers concrete results, too. In 2020 alone, over $16 million in tax refunds and benefits were received by community members with the support of income tax preparation services offered by SEED Winnipeg, a United Way Winnipeg supported agency and ACU partner, and its partner agencies.

One class can build an entire community

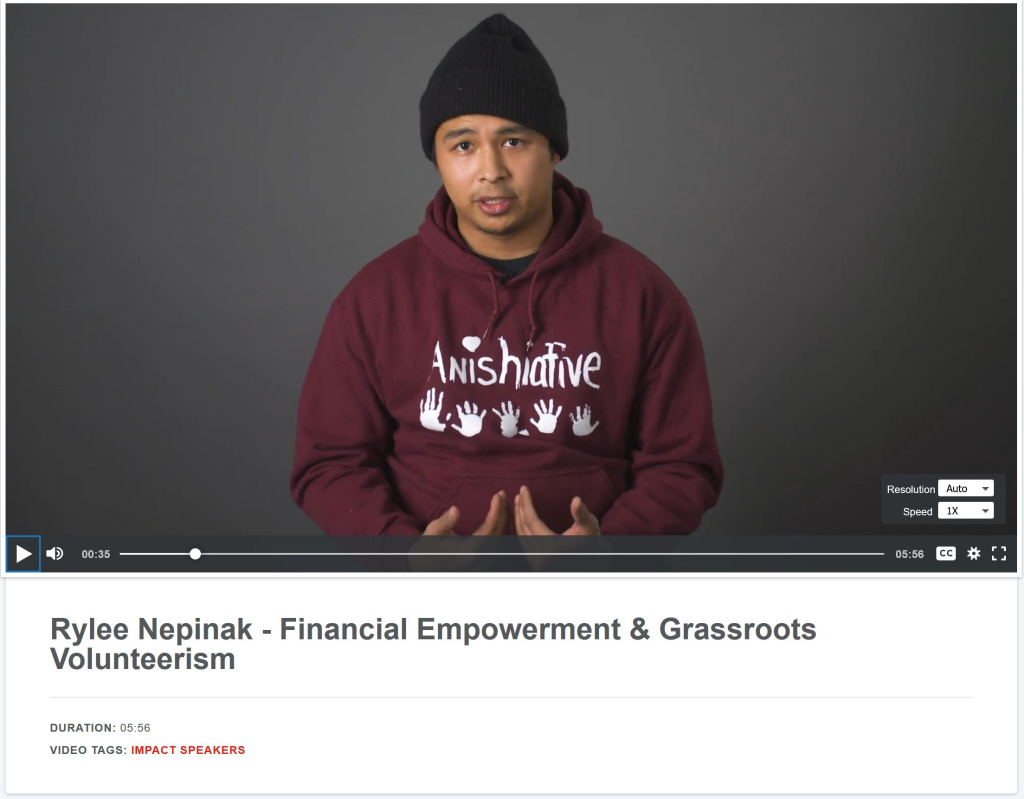

The impact that SEED Winnipeg has had on the community is more than just financial. Their work has impacted people like Rylee Nepinak, who took their money management training course through the Saving Circle program. These opportunities gave him the tools to break the cycle of poverty in his community by co-founding a grassroots, youth-focused organization called Anishiative in the summer of 2020.

He and his sister saw the disproportionate impact that the pandemic had on their community and determined to start a weekly volunteer green walk to pick up litter and distribute food to people in need. His relationship with SEED Winnipeg, a United Way Winnipeg agency partner, was the starting point of something larger than himself.

Empowering each other

The United Way Winnipeg and ACU relationship extends beyond one person or organization.

“ACU, United Way of Winnipeg, SEED Winnipeg, and other community partners have worked together to create financial empowerment programs for hundreds of people in our communities every year. It is a collaboration that has changed lives by working together to create opportunities for those who need it most,” explains Brendan Reimer, Strategic Partner, Values-Based Banking at ACU.

The credit union is part of United Way Winnipeg’s Social Purpose Institute, a business support program that helps companies to create positive social change, and Empower Manitoba, a collaboration between 10 agency partners that help people and families living in poverty to save for life-changing assets.

These projects are prime examples of how philanthropic, financial service and community-building sectors can come together to make a real impact. While their individual mandates may be different, they are committed to working together to ensure that individuals and communities have the skills they need to build a better tomorrow.

Contribute to their success

After more than 15 years, the partnership between United Way Winnipeg and ACU continues to have a meaningful impact on the lives of people in our local community.

“ACU, United Way of Winnipeg, SEED Winnipeg, and other community partners have worked together to create financial empowerment programs for hundreds of people in our communities every year. It is a collaboration that has changed lives by working together to create opportunities for those who need it most.”

Brendan Reimer

Strategic Partner, Values-Based Banking

If you’re interested in supporting the work they do, investing in your community is just a click away.

Showing up for those who stepped up

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Borrow, General, Money tips

Read more ›

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…