Posted: March 09, 2023 by Vawn Himmelsbach in Invest, building wealth, financial goals, investing women

Investing advice for women

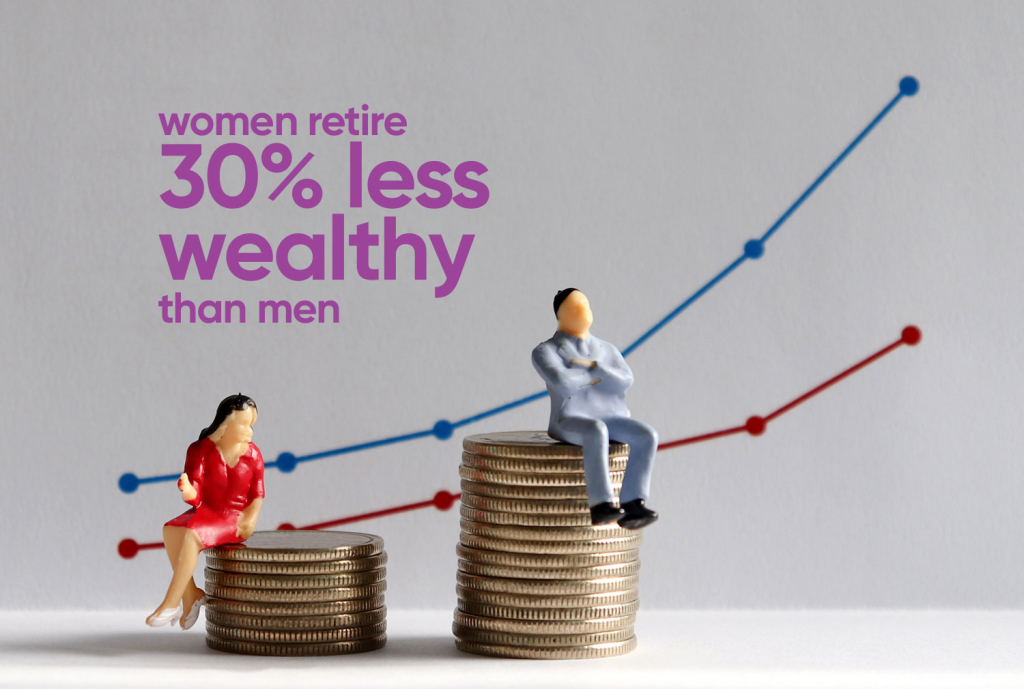

Some women may feel they’re at a disadvantage when it comes to building wealth, especially if they’re a single parent, divorced or widowed. In fact, on average, women retire 30% less wealthy than men. But it’s never too late to start on the journey to meeting your financial goals, saving for retirement and building wealth.

The best investing advice for women is that a gender-neutral approach isn’t necessarily best. That’s because, when it comes to money, women face uniquely different challenges than men.

Women are more likely than men to be caregivers if they have children, which shortens the number of years they work — sometimes impacting their career trajectory and earning potential. On average, a woman earns 89 cents for every dollar that a man earns — and it’s often even less for racialized women. In fact, 10% of women in Canada live on low incomes.

Further, the “second shift” of unpaid domestic labour women often work leaves them overwhelmed and with less free time. Combined with gendered ideas of who should manage money in a household, this reality makes it less likely for women to seek financial advice.

It’s never too late to get started

Increasing financial literacy is key to feeling empowered and confident when it comes to money management and to helping women become savvy savers.

“When I meet with couples, I try to educate them both, regardless of gender. However, for women who haven’t yet gained financial knowledge and might not have the same opportunities, I want them to understand what they’re investing in and why,” says Lisa Matwyko, Wealth Advisor at ACU and Aviso Wealth.

Regardless of their relationship status, the best investing advice for women is a simple rule: pay yourself first. That means putting aside a certain amount — say, 10% of what you earn — on a regular basis, and then increasing that amount when you can. “Most people don’t pay themselves first, as they want to make sure there’s a roof over their heads,” says Lisa. “But it’s important to think long term.”

This advice applies especially to women, who are more likely to spend money on dependents over building personal wealth. This explains their lower average overall savings compared to men. Research has found that women are less confident than men that they would be able to manage an unexpected expense of $2,000.

Taking small steps to build wealth

Trying to get a handle on finances — including debts and investments — can be intimidating at first.

For example, a single woman may be left unable to pay her expenses with one income instead of two, or a widow relying on her husband’s pension for retirement might be worried it won’t be enough to sustain her. Other women may have significant investments, but not know how to manage them.

“Women tend to be hard on themselves, but it’s never too late to start a financial plan — and it doesn’t have to be complicated,” says Jane Czuboka, Wealth Advisor with ACU and Aviso Wealth. “It might be as easy as putting together a budget in your living room or sitting down with an advisor.”

Keeping on track with your financial plan

Stay invested and review your plan at least once per year. Your plan could involve short, medium and long-term goals, such as saving for a house.

“Having a financial planner can help you stay on track,” says Lisa. “At ACU, we can create a financial fitness plan and show you how to budget, live within your means and start a pre-authorized contribution. You can start small, and later get into savings and investment strategies.”

Even setting aside $25 a week can add up over the course of a lifetime, so the sooner you start the better. Regardless of your social or marital situation, it’s still important to have a high-level view of your finances.

“ACU has a lot of tools, calculators and resources to help people understand their net worth and create their budget online, so it doesn’t have to be complicated,” says Jane.

This includes Qtrade Direct InvestingTM (for investment education resources) and NEI investment tools, a budgeting calculator, a net worth calculator and a savings growth calculator, which highlights the power of compounding. There are also plenty of financial literacy resources for Canadians that can help. And it’s worth reading The Wealthy Barber — a classic guide to successful financial planning.

Finding an advisor who has your back

An advisor can help you set up a financial plan best suited to your needs, especially as those needs change and evolve.

“It usually starts with determining your net worth and financial goals, and then setting up a monthly budget and implementing some investing and debt pay-down strategies,” says Jane. “Over time, your financial position can be improved, measured and monitored — helping you develop a clear path to achieving your financial goals and dreams.”

An advisor can also help you understand where TFSAs, RSPs, RESPs and RDSPs might fit in. For example, a young person who doesn’t need a tax deduction might opt for a TFSA, or a young mother might be interested in an RESP.

“It’s never too late to start your financial planning journey. Invest some time in connecting with a financial advisor who understands your values and disposition,” Jane recommends. “Feeling empowered financially is life-changing. We are here and happy to help you on your journey!”

Talk to a trusted ACU financial advisor and begin your journey to building better wealth.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc.

Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.

Up Next

Advice/Perspectives, Community stories

Read more ›

Manitoba Theatre for Young People dreams big with new campaign

A home for creativity and imagination for generations, Manitoba Theatre for Young People (MTYP) has helped thousands of children and youth across the province discover the joy of theatre since…

Advice/Perspectives, Community stories

Read more ›

Zoongizi Ode creates housing solutions to help Indigenous youth aging out of care

For the past decade, Indigenous-led not-for-profit organization, Zoongizi Ode (Zoon-gai-zai O-day), has been working on smoothing the transition for Indigenous children aging out of Manitoba’s child welfare system. Along with…

Money tips, Save

Read more ›

How much money should I save for retirement?

‘The best is yet to come!’ If this classic saying holds true, then your retirement is certainly something to look forward to! Leisurely time with family, friends, travel and hobbies…