Make a positive social impact with an ethical Manitoba investment

In its 19-year history, this made in Manitoba investment fund has leveraged more than $21 million in financing for not-for-profit organizations, co-operatives and social enterprises. Here is who they are and how you can get involved.

Unique in Manitoba, the Jubilee Fund is a local non-profit charity that is devoted to making a positive social impact on the community by providing loan guarantees for community-based projects that reduce poverty and financial exclusion. Projects could range from low-income housing to worker co-op business opportunities. In fact, they currently have over $1 million working towards worthwhile local initiatives.

In the year 2000, Winnipeg’s economic development and faith communities were exploring new ways to address issues of homelessness and poverty in the city. The idea evolved to help organizations leverage their available funds to make a bigger impact in the community. Those efforts took flight, and the Jubilee Fund was born.

Since then, this ethical Manitoba investment fund has helped secure financing for many organizations including Manitoba Green Retrofit, Diversity Foods at the University of Winnipeg and Visions of Independence in Portage la Prairie. They have also received local support from organizations and individuals, including faith-based groups such as the Archdiocese of Winnipeg and the Archdiocese of St. Boniface. Now, the Jubilee Fund is looking to spread their message further for continued social impact.

Here’s how the Jubilee Fund works and several ways you can get involved.

How the Jubilee Fund provides access to finance

Accessing financing is one of the biggest challenges for any organization. Sometimes, traditional financing routes aren’t available, or the applicants don’t have the collateral and equity to get the loans they vitally need. This can leave organizations feeling stuck.

In these instances, the Jubilee Fund may be able to help by providing loan guarantees. A loan guarantee is an agreement to take over the debt in the event the organization can’t make their loan payments. Through the Jubilee Fund, approved organizations will then be able to access credit with Assiniboine Credit Union (ACU) in order to do their great work in our community.

We’re not the biggest piece of the loan, but we are the piece of the loan puzzle no one can find. Our loan guarantee might be for $100,000, which in turn enables a $500,000 loan. It’s that financial piece the organization doesn’t have in order to be able to do what they want to do,” explained Executive Director of the Jubilee Fund, Derek Pachal.

Applicants are assessed based on their financial viability, operational skills, management skills and their social benefit for the community — specifically relating to how the initiative will reduce poverty.

Raising funds and “ethical investing” in JICs

The organization raises money in the community through donations, memberships, government grants, interest earnings and their own investment certificates — called the “Jubilee Investment Certificate,” or JIC for short.

For individuals and organizations looking for an ethical and social investment, the JIC is a local ‘made in Manitoba’ option to consider. Think of this like a GIC, but with an important poverty reduction difference. Your investment helps contribute to initiatives containing attributes of human dignity, environmental integrity and the use of locally produced goods, among other factors.

A JIC is similar to a GIC (Guaranteed Investment Certificate),” Derek explained. “We sell JICs in three and five-year terms, for a minimum of $1,000. While the JIC is not guaranteed like a GIC, and the interest is lower than a GIC, at the end of the day, you get your investment back and make a small amount of interest. Giving up a bit of interest changes lives — think of all the community groups that can use that equity to further their mission.”

You can learn more about this ethical Manitoba investment opportunity from their investor page.

In addition to managing the administration required for the JICs, ACU has been proud to provide annual operating grants and sponsorships to the Fund. Potential donors can learn more about ways to contribute in their donor brochure.

An effective partnership

Through a creative and flexible approach to social-impact lending, the partnership between the Jubilee Fund and ACU shows a commitment to local community economic development (CED) initiatives.

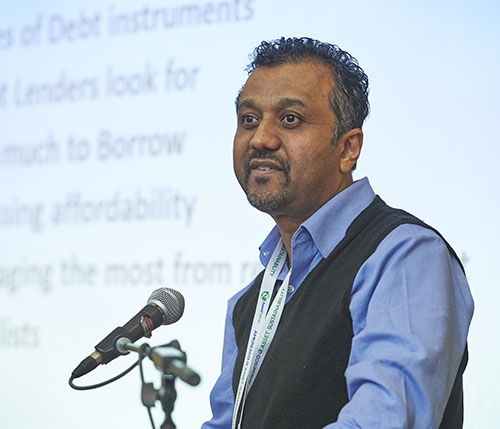

On our side, we try to leverage what we do best to serve our members by providing access to appropriate loans and deposits,” said Nigel Mohammed, Director of ACU’s Community Financial Centre. “But when organizations cannot satisfy financing criteria required to take on debt, the Jubilee Fund’s mission is to be that missing piece of the puzzle.”

To support the partnership, ACU brings expertise in assessing credit risk, loan portfolio management and providing financial advice to guide small business, non-profits and co-operatives that are undertaking financing.

That complementary connection is clear to Derek.

The advantage is that we don’t have to duplicate our skills,” he explained. “ACU does what they do best and the Jubilee Fund does what we do best. Neither of us could be as successful without each other.”

Get involved at Jubilee’s upcoming public event

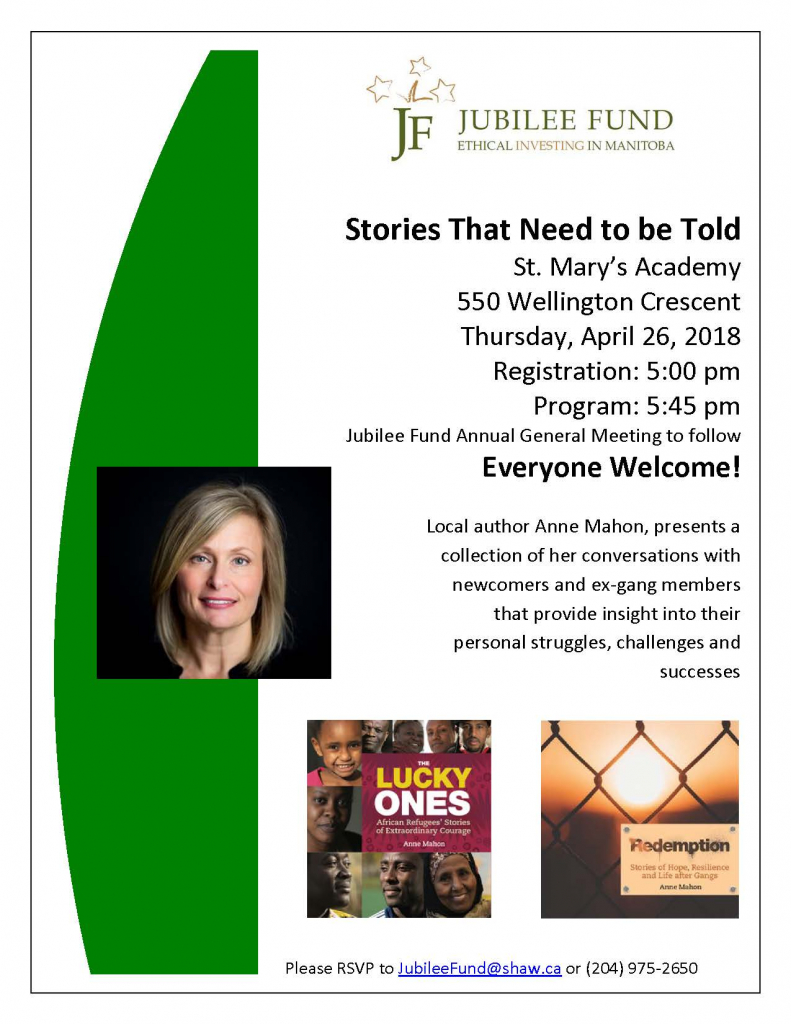

The Jubilee Fund will be holding its free “Stories That Need to be Told” public event on April 26, 2018 at St. Mary’s Academy in Winnipeg. The event aims to paint a real picture of what the organization does in the community.

The event will feature Winnipeg author Anne Mahon who will present a collection of her conversations with newcomers to Canada and ex-gang members that will provide insight into their personal struggles, challenges and successes. Mahon is the author of books including The Lucky Ones: African Refugees’ Stories of Extraordinary Courage and Redemption: Stories of Hope, Resilience and Life After Gangs.

Attendees at the public education event will get a real idea of what we do and the impact their $1,000 JIC can have,” Derek said. “Mahon will speak about some of the projects we have financed with ACU, and you’ll hear about the positive impact for individuals involved.”

Registration opens at 5 p.m. and the program will get underway at 5:45 p.m. For more information about the event or how to get involved with the Jubilee Fund, please RSVP to jubileefund@shaw.ca, phone 204-975-2650 or visit jubileefund.ca.

This revitalized historic building is making a big impact on West Broadway

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…