Posted: June 29, 2021 by Kelly Melchor in Money tips, Protect, fire, first-time homebuyer insurance, home insurance basics, home insurance coverage, insurance policy, insurance policy rate, insurance tips, liability, personal liability, property protection, renters insurance, tenant insurance, unforseen events, water damage, WIB, windstorms, Winnipeg Insurance Brokers, Winnipeg Insurance Brokers Limited

What’s covered by home insurance & am I properly protected?

This is a guest post from Kelly Melchor, Executive Director of Winnipeg Insurance Brokers. Winnipeg Insurance Brokers Limited is a fully-owned subsidiary of Assiniboine Credit Union, which means we can offer ACU members a special group insurance program, with discounts on home insurance!

You might be thinking – do I need insurance to protect my home (whether that be a house or condo)? The answer is yes!

Having insurance on your property protects your largest investment that you have worked so hard to achieve. You’ll want to protect your home against damage from unforeseen events such as a fire, water damage, windstorms, theft and even personal liability from an injury that happens on your property. In most cases you also require a property insurance policy from your financial institution or lawyer in order to secure any mortgage funding.

Having this protection gives you the peace of mind that you and your home will be taken of should something unexpected happen.

Getting property insurance in Winnipeg is easier than you might think

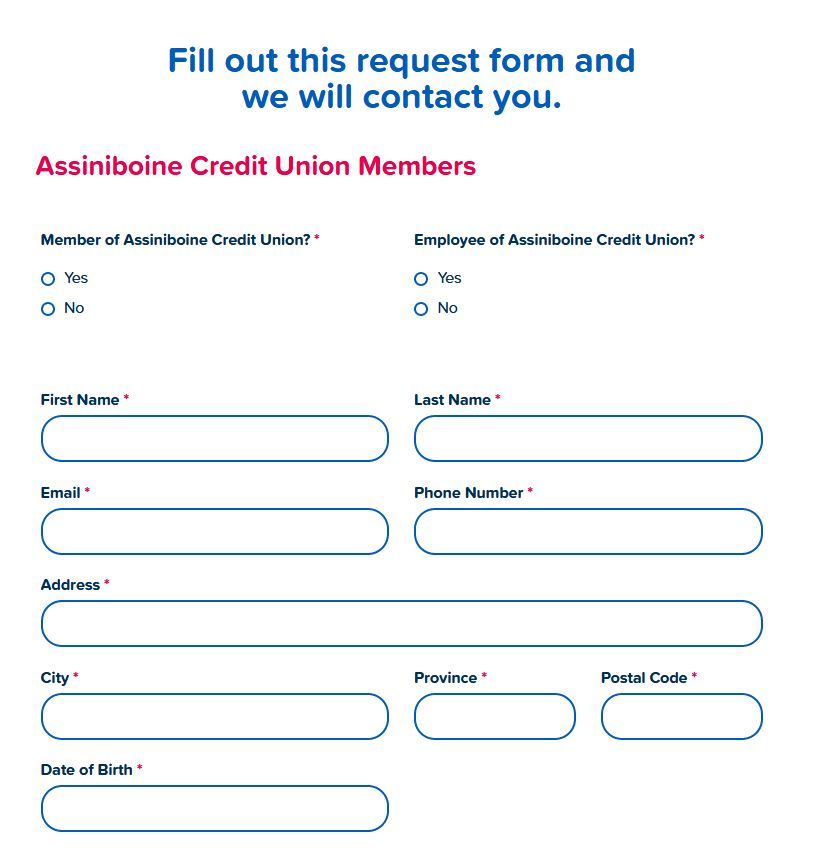

When you work with an insurance broker (or an Insurance Consultant on our team at Winnipeg Insurance Brokers Ltd.), you will be asked for some basic information to help provide you with a house insurance quote. Here’s what you should expect to provide:

Personal details

- Your name

- Contact information

- Date of birth

- Any prior insurance and/or claims history

Property details

- Physical address and postal code of the property you’re insuring

- The year the property was built

- The construction type (wood frame, brick or concrete)

- The number of stories and bathrooms

- The size of the main living areas, basement areas (finished and unfinished) and any decks, porches or patios

- Information about detached structures such as garages, sheds and gazebos

- Any special features such as fireplaces and swimming pools

- Heating, electrical, roofing and plumbing details

Typically, your realtor can help you get all of this information if you’re not sure of all the answers — which is often the case if you’re just buying your new home. You can also speak with your builder or chat with the previous property owner to see if they have those details.

What will happen with this information?

Your Insurance Consultant will take this information and look for the most comprehensive property insurance coverage at the most affordable cost with the range of Winnipeg insurance companies they have available to them.

Once you have made the decision on which house insurance policy fits your needs the best, you will complete the application and it’s over to the insurance company to underwrite. You’re one step closer to protecting everything you’ve worked so hard to get!

What will my home insurance policy cover?

A typical home insurance policy covers the following:

- The building

- Detached structures on the premise

- Personal property

- Loss-of-use of your dwelling

- Personal/legal liability

In addition, there may be a couple of other options to consider. You may want to add options for limited coverage on special items such as jewelry. And other options you can add to your policy include sewer backup coverage, service line coverage and overland water coverage.

Be sure you are aware of your options and choose what’s best for you.

When should I start getting my home insurance policy?

Your insurance policy is a legal document valid for a one-year contract, and it renews annually. Under this contract, the insurance company agrees to repair or replace your home in the state it was just before there was a loss, subject to certain conditions.

Be sure to review the details of your house insurance policy with your Insurance Consultant so that you’re aware of what is covered — and what may not be covered. The worst time to dig into the details of your coverage is after a claim needs to be made. So take the time upfront to understand your policy.

It’s best to start looking for your house insurance options about two weeks prior to when you need the coverage in-force (meaning, when your insurance is active and will cover you in the event of an issue.).

To get the best property insurance rates in Winnipeg, consider having a home inspection completed, and establish your insurance history in advance if possible. Be sure to share all information with your Insurance Consultant so that you can take advantage of any special discounts that could be available to you. By selecting higher deductibles and taking advantage of those discounts, you’ll be able to get the most affordable premiums.

Manitoba mortgage FAQs answered

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Borrow, General, Money tips

Read more ›

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…