Posted: October 19, 2023 by Asterisk Blog in Advice/Perspectives, Community stories, benefits of credit unions, international credit union day

Credit unions vs. banks: 4 credit union benefits that banks don’t offer

Oct. 19 marks the 75th anniversary of International Credit Union Day, a celebration of the global credit union movement that has been taking place on the third Thursday of October since 1948.

Spearheaded by the World Council of Credit Unions, the goal is to raise awareness of credit unions, promote their achievements and share member experiences. To recognize this day, we’re exploring how credit unions got started, the ways a credit union differs from a bank, and how you benefit from being a member.

Credit unions vs. banks: What’s the difference?

Many of the key financial services that banks offer—like chequing and savings accounts, mortgages, business loans, investment advice and wealth management—are available at credit unions. So, too, are financial products like registered savings plans and mutual funds.

And your money is just as safe—if not safer. All provinces in Canada have deposit guarantees for provincial credit union members that are equal to—or in some cases higher than—the big banks.

For example, the Deposit Guarantee Corporation of Manitoba (DGCM) provides a 100 percent guarantee of deposits held with Manitoba credit unions such as ACU. On the other hand, deposits placed with federally regulated banks are insured by the Canada Deposit Insurance Corporation (CDIC) and cover only up to $100,000.

The main distinction is that, unlike traditional banks, credit unions are co-operatives. Where banks are largely owned by shareholders—investors whose primary interest is maximizing profit—credit unions are owned by their members. Decisions are made to serve the best interests of the membership and community instead of focusing solely on profits.

How do these differences benefit you as a member of a credit union?

Credit unions put values first

Because they are not motivating by maximizing profits for shareholders, credit unions are able to place values before profits. For instance, ACU values integrity, accountability, diversity and inclusion, service and cooperation. We ‘live’ these values through our efforts toward truth and reconciliation, affordable housing, diversity and inclusion and poverty alleviation.

ACU is also one of Canada’s greenest employers, the first carbon-neutral credit union in Manitoba and the first Canadian organization to purchase Fairtrade-certified offsets. We recognize that long-term investment in the planet will pay dividends for years to come. As a result of efforts like these, ACU has achieved global B CorpTM certification based on rigorous third-party evaluation.

Credit unions are member-driven

As co-operatives, credit unions are also accountable to their members’ values. While banks prioritize profits for shareholders, credit unions re-invest profits to better serve members through improvements to products and services, better rates and community investment.

For example, each year ACU donates funds to build resilience and equity in the local community. In 2022, ACU made a $15,000 donation to Manitoba’s Jubilee Fund for the Rent Guarantee Program, designed to help women in need of stable housing. ACU even provided an opportunity for new members to contribute to restoring Winnipeg’s tree canopy, with a donation made to Trees Winnipeg each time a new member joined, totalling $20,000.

Credit unions can offer lower fees and better rates

People interested in switching from a big bank may be surprised to learn that credit unions typically offer lower service fees and better deposit and lending interest rates. When shareholder profit isn’t the consideration, credit unions can support economic development initiatives that affect and benefit entire communities.

Credit unions offer more flexible loans with personalized service

All banks have rigid criteria for loans, as do credit unions, but having extensive knowledge of the community they share with members, they can often offer more flexible options.

Credit unions lend to a wider range of Manitobans, not just typical high-earning candidates with great credit scores. An ACU advisor will work with you to find financing that fits your needs, even taking into consideration your background and religion, as demonstrated by an Islamic mortgage option.

How credit unions got their start

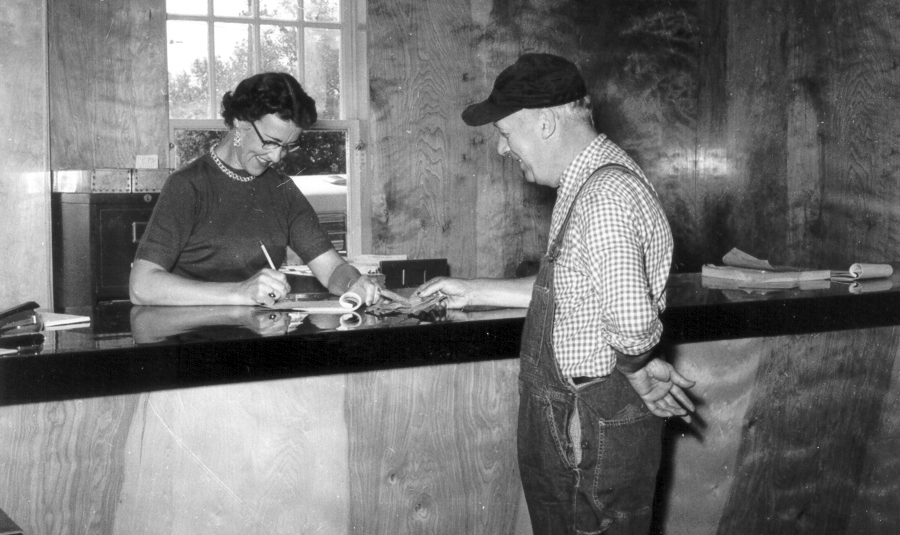

The foundation for credit unions as we know them today began with German financial co-operatives in the 1850s and 1860s, which spread across Europe by the end of that century. These were part of a larger co-operative movement in other sectors, such as as agriculture, and formed the foundation for what we recognize today as credit unions.

In Manitoba, ACU got its start in 1943 during the Second World War. At the time, many Manitobans struggled to pay their bills and, as a result, fell victim to high interest rates charged by unscrupulous money lenders. That’s when Ed McCaffrey and eight co-workers from the Winnipeg Electric Company formed ACU. Money deposited by members was lent to other members in need, making banking fair and available.

ACU is a full-service financial co-operative with more than $5 billion in assets today, but its guiding principles remain the same: improving lives and bettering the planet.

Why ACU

Unlike a bank, ACU doesn’t have customers, but member-owners. Everyone becomes part of an organization that puts people before profits by investing in the community through education, partnerships and financial resources.

That’s why, this International Credit Union Day, ACU recognizes its member-owners who’ve helped shape the credit union and made it what it is today: a force for good.

Curious about what financial services ACU can offer you? Book an appointment with an advisor today!

Up Next

Community stories

Read more ›

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Borrow, Business growth, Community stories

Read more ›

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

Borrow, General, Money tips

Read more ›

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…