From 1943 to today: How ACU continues to build a sustainable future for all

In 1943, the Second World War had a firm grip on the economic realities for much of the world — Manitoba included. Everyday people were struggling to pay their bills, banks were ignoring their pleas, and in an attempt to say afloat, many Manitobans fell victim to incredibly high interest rates of payday lenders.

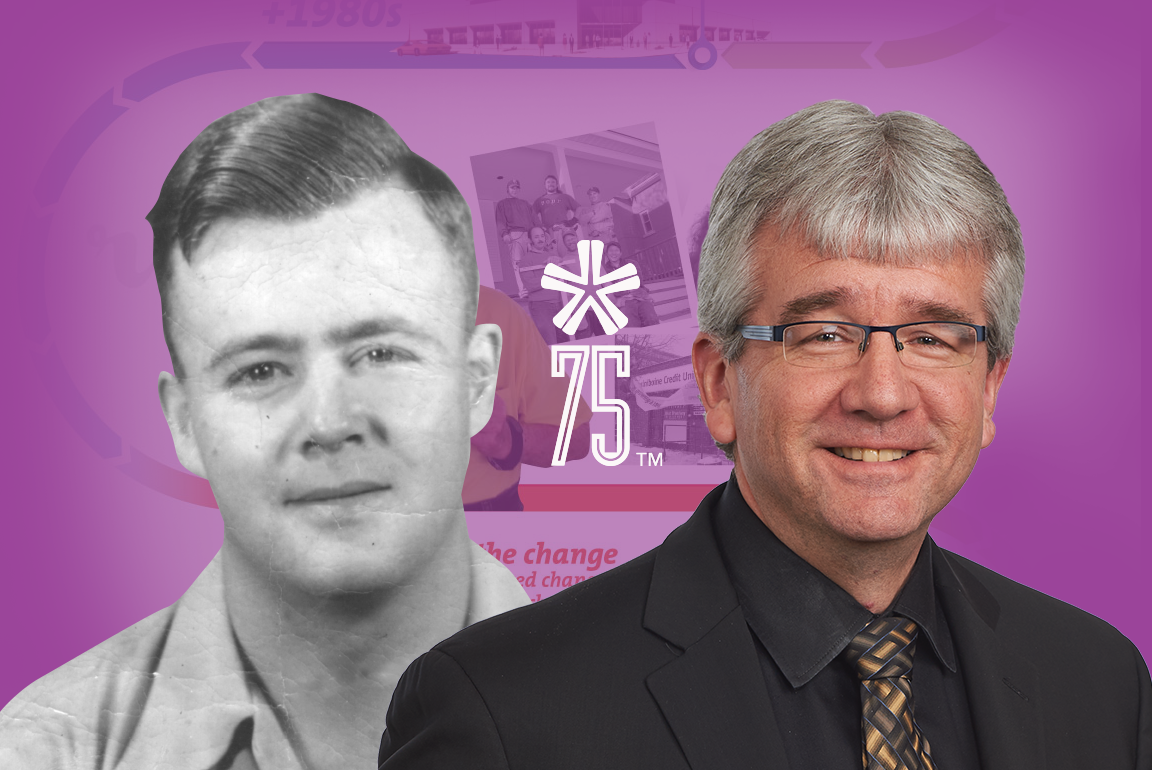

As a 23-year-old socially conscious young man, Ed McAffrey had grown frustrated watching his co-workers at Winnipeg Electric Company face these challenges. Along with his wife, Anna, Ed and eight colleagues came together to form Assiniboine Credit Union — an open bond credit union that everyone in the community was welcomed to join.

Related: Learn more about Ed McAffrey and the beginning of ACU.

Money deposited by members was lent to other members in need, which underlined the credit union’s social mission. In fact, the first ACU loan allowed a member to borrow $50 to pay an outstanding medical bill at a time before national Medicare was available. This remains who we are today — neighbours helping neighbours.

We made loans for reasonable purposes – like medical needs. If you had a genuine need we would do our best to see that you got a loan.” — Ed McAffrey

Although growth was slow at first (with only 33 members and assets totalling $2,567 by the end of the 1940s), Manitobans soon embraced the young credit union. By the end of the 1980s, ACU had become Manitoba’s second largest credit union with assets totalling $270 million and a membership of 35,550.

Now 75 years into the ACU journey, there are 125,500 members and assets totalling over $4.5 billion. While numbers and dollar signs can demonstrate a positive impact, the vision and purpose of ACU extends much further.

Today: Community accomplishments & firsts-of-its-kind

Since its beginning, ACU has taken pride in the achievements of its members, employees and community partners. Taking this positive approach to adding value in underserved communities, the credit union maintains a vision of building a “sustainable future for all.”

Here are some of the ways ACU has demonstrated this vision, along with some of the ‘firsts’ it has proudly achieved in recent years:

Local economic development: In 1996, ACU made Canadian history alongside Vancity Credit Union by developing the position of Community Development Coordinator. This role would assist ACU in its commitment to Community Economic Development. ACU continues to impact the local economy in alignment with our values by purchasing from local community enterprises.

Mission renewal: In 1991, ACU members took a big step forward to recommit to the values of social justice, community economic development, ethical investment and community accountability. This movement would later become known as the “Greening of Assiniboine.”

I had always believed that credit unions would not be as bureaucratic or impersonal as banks – which are all carbon copies of each other. Credit unions should have been community banks – providing more flexible service and more personal attention, particularly to the groups that were represented at meetings.”

— Dave Leland, who helped lead the “Greening of Assiniboine”

Planting a seed: One of the first initiatives that marked the “Greening of Assiniboine” was ACU’s support of SEED Winnipeg, an organization that was established to foster inner-city renewal through the development of micro-enterprises, co-operatives and other community based businesses. ACU established an internal $100,000 community loan fund for low-income entrepreneurs and made an annual commitment to SEED’s core operations, starting with a donation of $3,600. Matched savings programs were also established in partnership with SEED Winnipeg to help people with low income save and create new opportunities for themselves, and over 4000 people have benefited over the years.

Jobs for new Canadians: Partnering with SEED Winnipeg, ACU helped launch a program called Recognition Counts. The program provides loans up to $10,000 to low-income, skilled immigrants who need financial assistance in order to take any re-accreditation or training courses necessary for employment. Having reached nearly 300 loans, the program has found great success with over 100 participants already working in their field experiencing an average increase in income of more than $40,000 per person.

Women in leadership: By 1992, five out of nine ACU Board Directors were women, with Jan Lederman elected as chair of the board in 1994. Since that time, women have continued to hold important leadership roles on both the Board and the executive of ACU.

Sponsorships & grants: Currently, ACU contributes more than $500,000 annually in sponsorships and grants to dozens of Manitoba organizations whose mandate is to help build and support sustainable communities.

Social impact financing: In 1995, ACU created the Community and Small Business Loan Centre to handle loans under $150,000 with a mandate to target non-profit organizations, co-operatives, female entrepreneurs and other non-traditional groups. ACU’s financing for co-operatives, social enterprises, affordable housing, community facilities, and other nonprofits now total $186 million, while financing for affordable housing provides homes for 5000 low-income Manitobans.

Manitoba Tipi Mitawa: In another history-making moment, ACU was the first financial institution to partner with the Manitoba Real Estate Association and the Assembly of Manitoba Chiefs. Together, they were able to create the Manitoba Tipi Mitawa (MTM) program dedicated to providing financial support toward homeownership for Indigenous peoples.

Islamic Mortgage: ACU also worked alongside leaders from Winnipeg’s Muslim community to create the first Islamic Mortgage of its kind in Canada.

Job creation: In 1994, ACU became a key sponsor and co-founder of LITE (Local Investment Toward Employment), Winnipeg’s “foundation dedicated to job creation for people that need a hand up into work and out of poverty.”

Partnerships: In recent years, ACU has partnered with a variety of other social impact and environmentally focused organizations such as the Jubilee Fund, Green Action Centre, and many others to create positive local social and environmental impacts in our communities.

Manitoba Immigrant Integration Program: ACU partners with other credit unions to provide an opportunity for skilled immigrants to gain relevant work experience in their field. Candidates participate in a four-week training program to introduce them to Canadian culture and the Canadian banking system. They are then assigned to a three month, full time paid work experience, complete with customized training and potential for future employment.

New financial initiatives: ACU also expanded its business operations in 2009 by becoming a 50 per cent owner of Winnipeg Insurance Brokers Limited. Shortly after that, its ownership increased to 100 per cent. Further, ACU was strengthened with the introduction of the Assiniboine Financial Group (AFG), assisting members with their wealth management.

Environment: In 2008, ACU turned a former gas station and brown site into a Silver LEED (Leadership in Energy and Environmental Design) certified branch in Fort Richmond. In 2017 ACU, one of the greenest financial institutions in all of Canada, won a national Social Responsibility Award for having reduced Greenhouse Gas emissions by 56%.

House of Commons: As part of their 2009 pre-budget consultation hearings in Winnipeg, the House of Commons Standing Committee on Finance chose ACU, out of 427 Canadian credit unions, to brief them on the credit union’s contribution to community economic development. ACU continues to be sought out by governments for input on various issues including financial empowerment, poverty reduction, and affordable housing strategies.

Awards: Over the years, ACU has been honoured to receive multiple awards for its community involvement, financial assistance, environmental initiatives, and as a top employer, including:

- One of Manitoba’s Top Employers (2020)

- One of Canada’s Greenest Employers (2012 – 2020 inclusive)

- National Community Economic Development Award — North End Branch (2016)

- Manitoba Cooperative Association’s Cooperative Achievement Award based on contribution to SEED’s AssetBuilders Partnership (2011)

Commercial lending for local impact: As the lead lender, ACU helped True North Sports + Entertainment realize the dream of opening downtown Winnipeg’s MTS Centre in 2004. The structure is now viewed by many as the anchor of the ongoing downtown redevelopment. ACU provided additional lending to build the MTS Iceplex, further enhancing the city and province’s love of hockey.

Support in underserved neighbourhoods: Aiming to provide access to financial services for all members of the community, ACU opened the West Broadway and North End branches in response to communities being abandoned by traditional banks, and continues to be the only financial institution serving the town of Gillam.

Financial Access Program: ACU removes barriers to banking and invests in financial empowerment by making sure people can get the ID they need, gain the benefits of membership with ACU, have opportunities to strengthen their financial literacy, and save for their child’s post-secondary education.

Reconciliation: As one of its core values, ACU has put policies, programs and goals in place focused on diversity and inclusion, including engaging in the journey of reconciliation. In 2016, ACU made a commitment at a National Reconciliation gathering to welcome the opportunity to respond meaningfully to the Truth and Reconciliation Commission of Canada Calls to Action.

North End community: In 2018, the $12.8 million redevelopment of Merchants Corner in the Winnipeg’s North End showcased a community dream realized. Including residential, educational and other uses, the community was consulted in this project every step of the way, with ACU providing bridge financing. This is one example of many strategic investments ACU has made to strengthen Winnipeg’s North End.

A future legacy

Over ACU’s 75-year history, its deeply entrenched dedication to social values has made it one of Canada’s most community-minded financial institutions. Having proudly grown over the years with the support of its employees and partner organizations, the values that Ed McAffrey initially instilled into ACU will continue to ensure that the members remain the top priority.

As the community grows, Assiniboine Credit Union will be right there alongside, ready to make another 75 years just as successful and impactful.

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…