Meet Ed, ACU’s new live chat service

Ed is helping “Ed-ucate” members about ACU products and services, as well as assisting with their banking needs.

ACU’s new live chat service is designed to be convenient, secure and easy to use. Rather than calling in or visiting a branch, members can easily speak to an advisor using live chat.

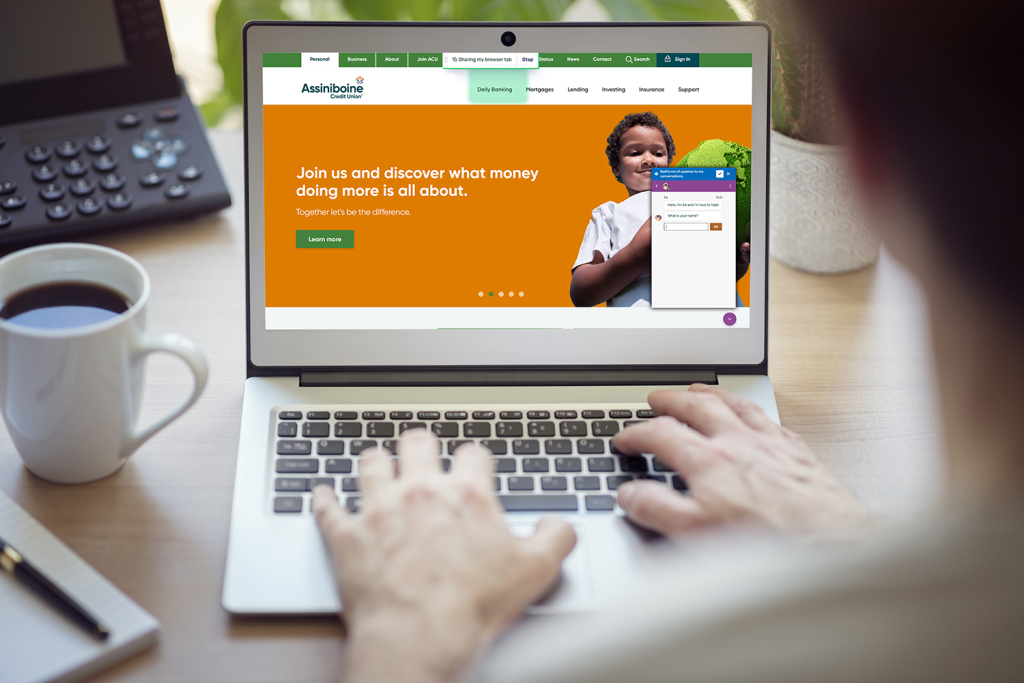

Members can instantly connect with an advisor through the ACU website or sign in to digital banking for an even better member experience. Additionally, advisors can initiate co-browsing with members within a highly secure environment and can assist with various banking needs, from walking members through an application to troubleshooting an issue.

Connecting is easy

If you’ve visited us online recently, you may have noticed the purple chat icon in the bottom right-hand corner — this is our live chat! Click to start a conversation.

Some of the key features and benefits of Ed:

- It’s convenient and secure

- It’s safe to co-browse inside and outside the online banking environment with a secure PIN provided by the advisor.

- It’s an accessible way to speak to advisors for hearing or mobility impaired members, including high-contrast colours and larger text sizes for better visibility and keyboard control

How Ed is enhancing the banking experience

Ed is based on a platform that enriches the digital experience by extending touchpoints and collaboration capabilities.

The platform also meets rigorous industry security and data privacy standards. Since members can chat with Ed before or after signing in to digital banking, they can feel confident that their chat session is secure.

And when it comes to accessibility, colours and text size matter. That’s why we’ve designed Ed with accessible themes, including high-contrast colours and larger text sizes for better visibility—and it’s easy for members to switch to these themes.

The story behind the name

So why is ACU’s live chat named Ed?

Ed McCaffrey was one of ACU’s founders and its very first member, when the credit union was formed in 1943.

Back then, credit unions were still fairly new in Manitoba, but Ed had a mission to support people who were struggling to pay their bills, get through tough times and avoid high banking fees. He played a significant role in shaping the ACU that members know today.

ACU honours that vision by deepening its commitment to provide financial services to the underserved, support local communities and work toward environmental sustainability—and by naming the new live chat feature after the man who started it all.

Putting people first

Ed McCaffrey’s banking vision was grounded in values that put the well-being of people first. At ACU, this vision continues by educating members about their finances through different life stages to help improve their financial health.

Ed is one of the tools that ACU uses to help spread that education. Building on ACU’s legacy, Ed is a new feature that can help members build a strong financial future.

Let our new live chat platform, Ed, walk you through the new features that enhance your online banking experience. Learn more.

Up Next

Celebrating the 10th anniversary of student-run credit union

Just over 10 years ago, a survey circulated at Winnipeg’s Technical Vocational High School. The results showed that students at the school, commonly known as Tec Voc, felt short-changed—they were…

Kilter Brewing Co. serves up craft beer and community connection in St. Boniface

Deep in the heart of St. Boniface, Kilter Brewing Company is a hidden treasure—an oasis for Winnipeggers to escape their day-to-day routines, enjoy craft beer and connect with their community….

How to use a mortgage calculator to budget better

Learn how to use ACU’s mortgage calculator to figure out how much mortgage you can afford, and what budget you should set before you start house hunting. A mortgage lender…