Posted: January 06, 2022 by Asterisk Blog in Invest, Money tips, financial check-up, GIC, mutual funds, RESP, RRSP, social responsible investments, TFSA, wealth care

Wealth care: “An apple a day” applies to your finances, too

Many people look towards the New Year as a time to reflect, make resolutions and look towards exciting improvements for the year ahead. Often, that re-set has to do with health and wellness. But regardless of the change in season or calendar, we still make regular visits to the doctor, have check-ups and ensure our general health is in order.

But what about our financial health?

Are you checking your wealth on a regular basis and ensuring your finances are sound, not just now, but long into your future? It’s never too late to start that workout regimen—and the same is true for your finances. Getting into shape will take time, patience and effort, but you can do it.

Where to start?

Many people don’t consider finances the same way they consider other aspects of their lives. You might plan and research more for a vacation than you do your own investment and financial needs. So doing a deep dive into your own finances will take planning and research. And filling in your knowledge gaps will help you understand your own wealth, along with the options to invest in the future.

4 investment vehicles that work for you

Retirement is often spoken of as a three-legged stool, where each leg represents a different part of our investment strategies. One leg is the government sponsored Canada Pension Plan and/or Old Age Security. A second leg is supported by a work-sponsored savings program (defined contribution or defined benefit plan. And the third leg usually represents personal savings.

RRSP

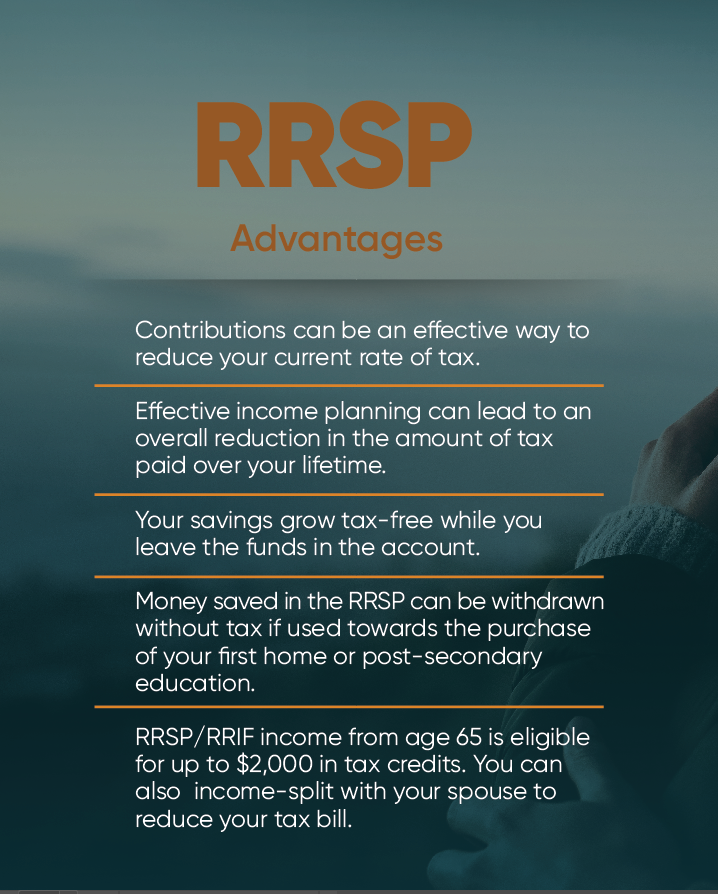

One of the great retirement savings vehicles has been around since 1957—the Registered Retirement Savings Plan (RRSP). Essentially, an RRSP allows you to contribute money or income to a registered plan. That money is not taxed when held within the account and can be put in a variety of investment vehicles.

The money actually helps you reduce the amount of income tax you pay during your working years. Furthermore, if you’re earning less after retirement, your savings will go further (as your income tax bracket decreases). However, there are limits on the amount you can put away, depending on your income, and there are withdrawal penalties if you take money out too early. When you turn 71, you’ll also be obligated to start withdrawing funds.

TFSA

A Tax-Free Savings Account (TFSA) works slightly differently, but is equally, if not more effective than, an RRSP. TFSAs allow you to invest money that has already been taxed, but the returns you earn on those investments are tax-free.

With a TFSA, you can invest for as many years as you’d like, but there are also limits as to how much you can invest each year. As opposed to an RRSP, TFSAs can be withdrawn at any time, for any reason, without penalty, and they have no impact on your income tax or government benefits.

GIC

People with short-term goals may consider Guaranteed Investment Certificates (GICs). GICs provide interest on money invested with little risk. There is usually a term to the investment like a bond. The downside is that with lower risk comes lower investment returns compared to other investments in the markets.

RESP

Another tax-sheltered savings plan is the Registered Education Savings Plan (RESP). This allows you to save money towards a child or grandchild’s post-secondary education. Interest and/or returns earned within RESPs grow tax-free, similar to the TFSA.

The best part of the RESP is the government-matching program that helps you grow your money even faster. If you contribute the maximum yearly allowable amount of $2,500, the government will provide an additional $500 each year up to a limit of $7,200.

Where should I put my money?

Once you’ve planned out your needs and have earmarked where that money will be best used in the future, you’ll need to consider the right investment options for that money.

Let’s say you are a young family with many working years ahead of you. Perhaps you can afford some market volatility because you plan on keeping your money invested for some time. In that case, you may want to consider mutual funds that invest in the stock market.

Mutual funds essentially pool money from many investors, creating a fund that has buying power to invest in the stock market. Those individual stocks will make up the entirety of the fund.

Some funds simply follow the various stock indexes, while others invest in specific industries—for example, tech, entertainment, financial and oil, to name a few. Some mutual funds come with fees, which should be considered before investing. Other mutual funds are high-risk, medium or low risk, which you would have to speak with your advisor about to measure your risk tolerance.

Also, you may want to re-balance your portfolio approach over time and as you enter different phases of life. For example, you may have a riskier portfolio when you are younger and have time to pass through big swings in the market, but as the years pass and you get closer to retirement, you may adopt a more conservative (less risky) portfolio.

Conscious investing

Oftentimes, we may not consider where mutual fund portfolios are putting our money. But lately, people have looked at investment as a way to give back or do more than just invest.

Socially responsible investing focuses on investments that perhaps do more for the environment, create less waste and manage our resources. For example, many funds have removed tobacco and alcohol from their portfolios, some investments will only invest in companies who have signed onto the UN Principles of Responsible Investing, and so on. It all depends on your desire to give back and how best to use your personal finances to achieve more than just personal returns.

Make your wealth a priority

For a lot of people, getting started process can be daunting. But speaking with an ACU financial advisor (much like you would your doctor) will allow for an initial prognosis to see what is working, what needs work and how best to maintain a financially healthy future.

Those initial consultations are critical. A detailed analysis of your finances will help you answer questions about how to even begin a financial plan, how best to save for retirement, what investment vehicles work best (and the costs of each), in-person versus digital financial planning and so on.

It all begins with a plan, and we’re ready to help you get started.

Book a financial health check-up with an ACU financial advisor that fits your schedule.

Together, we’ll review your current wealth, future goals, and make a plan to get you there. We’re here to help.

Up Next

Community stories

Read more ›

Sustainability: How ACU is turning words into action

A hand holding a seedling

Advice/Perspectives, Community stories

Read more ›

For ACU, Pride radiates outward

“I’ve always wanted to instill a change in the world for the better,” says Cristina McCourt, Financial Account Manager Trainee and member of the ACU Pride Committee, an employee-led resource…

Advice/Perspectives, Borrow, Business growth

Read more ›

Royal Aviation Museum travels to its final destination—with ACU’s help

A stone’s throw from the main terminal of Winnipeg Richardson International Airport you’ll find one of Canada’s hidden gems, where the airplanes are a little more exciting than your typical…